The New Zealand dollar dropped half a percent on Friday, falling to the 0.68 threshold, last seen in August 2021.

Late Thursday, the World Health Organization announced that it's monitoring a new Covid-19 variant with "a large number of mutations," detected mainly in southern Africa. Moreover, it could be resistant to vaccines. That led to an immediate sell-off in stocks, hitting commodity-linked currencies as well.

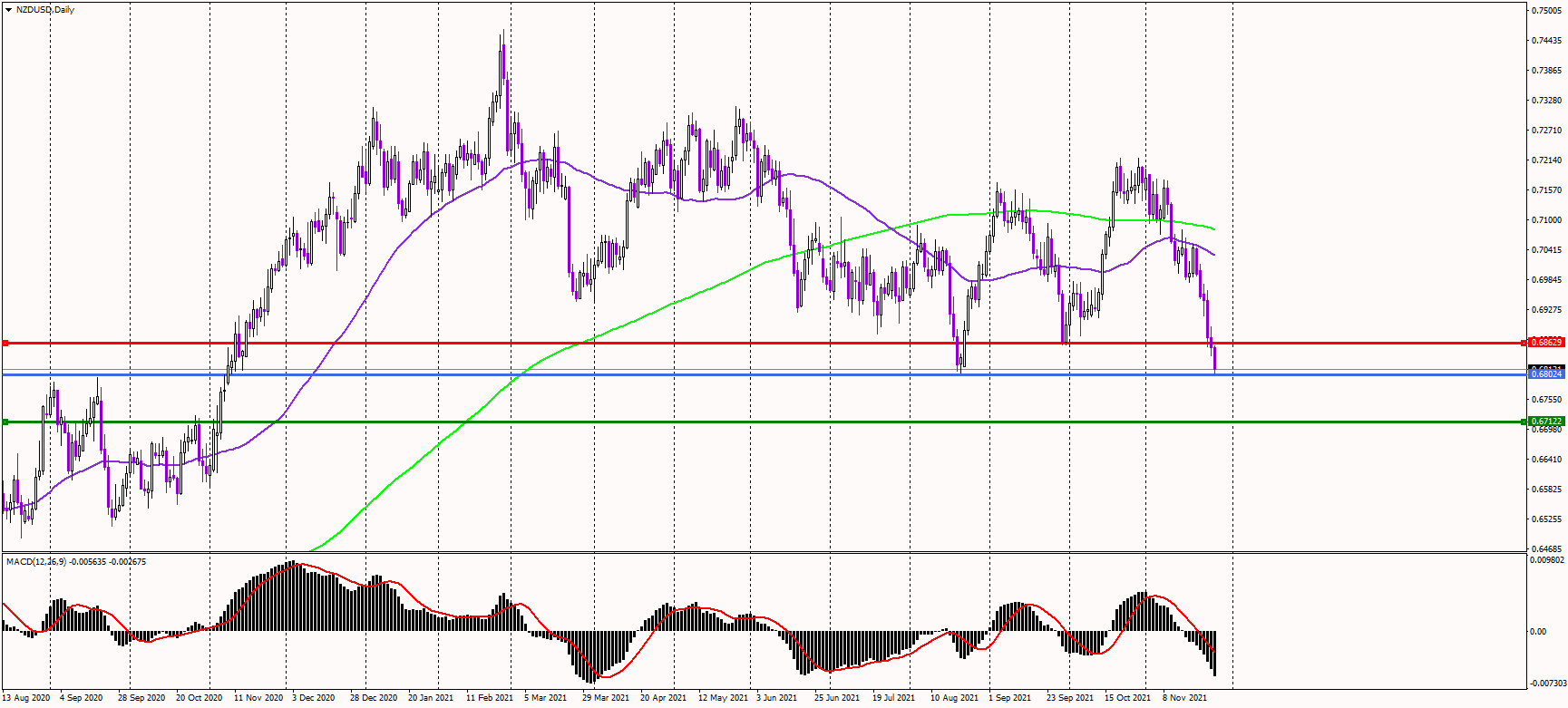

For now, the kiwi looks oversold and therefore it could be ready for a bounce. In that scenario, we might see a strong double bottom pattern, implying a reversal from the current bearish trend.

The target in a potential relief rally should be at 0.6860 and if the price jumps above it, the short-term trend might change to bullish, possibly leading to another leg higher toward 0.6950.

Alternatively, if the NZDUSD pair drops below the 0.68 threshold, significant stop- losses of long positions will be hit, likely causing further bearish pressure, with a possible drop to 0.67 in the initial reaction. That would also represent new one-year lows for the New Zealand dollar.

NZDUSD daily chart 3:30 PM CET