Trading Coffee through Contracts for Difference

Before diving into the specifics of coffee, a solid understanding of how CFDs work and how they differ from buying futures contracts is required. These are some of the key features of trading coffee through a CFD:

- A CFD is a cash-settled derivative. This means you never physically buy, sell, or take delivery of coffee. You are speculating on a contract designed to track the prices of coffee futures in major markets. Using a CFD thus allows you to speculate on coffee prices without ever having to worry about rolling over a futures contract or undertaking physical delivery.

- CFDs allow you to use leverage, enabling you to use your capital more effectively. Using leverage wisely allows you to hold multiple positions at a time without tying up all your capital in just one asset. It also allows you to size up positions and potentially make significant profit from intraday swings that would otherwise achieve only a small percentage gain. Leverage is a tool; when used wisely, it can amplify potential returns, but if used without understanding, it will increase the size of losses.

- Unlike a physical investment, holding a CFD position past the daily market close typically incurs an overnight financing charge (or 'swap fee'). This cost makes holding positions for long periods less profitable. Therefore, the strategies discussed below are suited more for short to medium-term trades instead of longer-term investments.

Where and under what circumstances do coffee beans grow?

To correctly interpret the fundamental weather circumstances that drive prices, we first need a short introduction on how coffee is actually grown and what environment it requires.

Here we already need to make a distinction into what kind of coffee we’re talking about. There’s Arabica, which is generally thought of as the higher-quality, tastier coffee, or Robusta, which is easier to produce.

Arabica

- Sensitive, requires an altitude of 1000-1800 meters

- Lower yield, and also more labor-intensive

- A more fragile shrub

- Dominant in global production (60-70%)

- Primarily grown in Latin America (Colombia & Brazil) and East Africa (Ethiopia & Uganda)

Robusta

- Tougher, requires lower altitude, and tolerates varied conditions better

- Higher yield, easier to grow

- Tougher tree

- About 30-40% of the world's production

- Primarily grown in South-East Asia (Vietnam & Indonesia)

The coffee supply chain exhibits extreme geographic concentration, which is one of the primary sources of its systemic risk. Production is exclusively possible inside the so-called ‘coffee belt’. This concentration means that localized weather incidents can rapidly translate into significant price spikes. For instance, the frost event in Brazil in July 2021 destroyed just 10% of the crops, but still led to prices surging over 30% in a matter of six trading days.

Fundamentals

The demand side of coffee is relatively price-inelastic, due to the way that coffee has been ingrained into most countries’ cultures, meaning that demand stays relatively flat regardless of prices. Studies have shown that with every 1% price increase, demand only drops by a quarter percent. Because of this nuance, the most important fundamentals to consider are those that drive the supply of coffee.

The Climate Risk

As we noted earlier, coffee production is very geographically focused, which has the result of small weather incidents leading to big price increases. Furthermore, global warming has led to the maturity cycle for coffee beans shortening, which inherently lowers their quality, leading to another potential catalyst for higher prices.

Tariffs

Due to coffee’s geographical constraints, the countries that are the biggest consumers (North America & Europe) are unable to grow any coffee themselves, and they are thus completely reliant on export from coffee-growing regions.

This nuance makes international trade policy all the more important. For example, with the current 50% American tariffs on all Brazilian exports, coffee trade between the two countries has come to a standstill, being a significant key in the strong rise of Arabica prices.

Certified stockpiles

The ICE Futures US exchange, where the benchmark Coffee C Futures product (Arabica) is listed, maintains certified warehouses in the U.S. and Europe. The quantity of coffee in these stockpiles, which represents physically approved inventory, acts as a useful gauge for immediate market tightness. Over the past years, these inventories have consistently gotten lower and lower. For reference, January 18th, 2021, had an inventory of 1.527.991 bags, whereas on October 1st, 2025, we saw a total supply of merely 484.247 bags.

Low stocks allow fears over even minor weather incidents to quickly escalate into major price swings, providing good opportunities for volatility-based trading setups.

Forex: A Leading Indicator

Since coffee is universally priced in U.S. Dollars, currency exchange rates in the major producing countries directly dictate the export competitiveness and the selling incentives for local farmers. The relationship between the Brazilian Real (BRL) and the USD is particularly vital for the Arabica contract, with the Vietnamese Dong (VND) being the most important currency for Robusta contracts.

For example, if the Brazilian Real weakens relative to the USD, Brazilian producers receive a higher amount of BRL for every dollar of coffee exported. This provides a strong incentive for producers to maximize export sales in the short term. This currency-hedge loop can inject non-fundamental, short-term supply pressure into the USD-denominated Arabica futures, acting as a short-term bearish force.

Monitoring BRL/USD for Arabica Coffee, along with VND/USD for Robusta Coffee, can thus serve as a leading indicator.

Market Participants: Who Drives Prices?

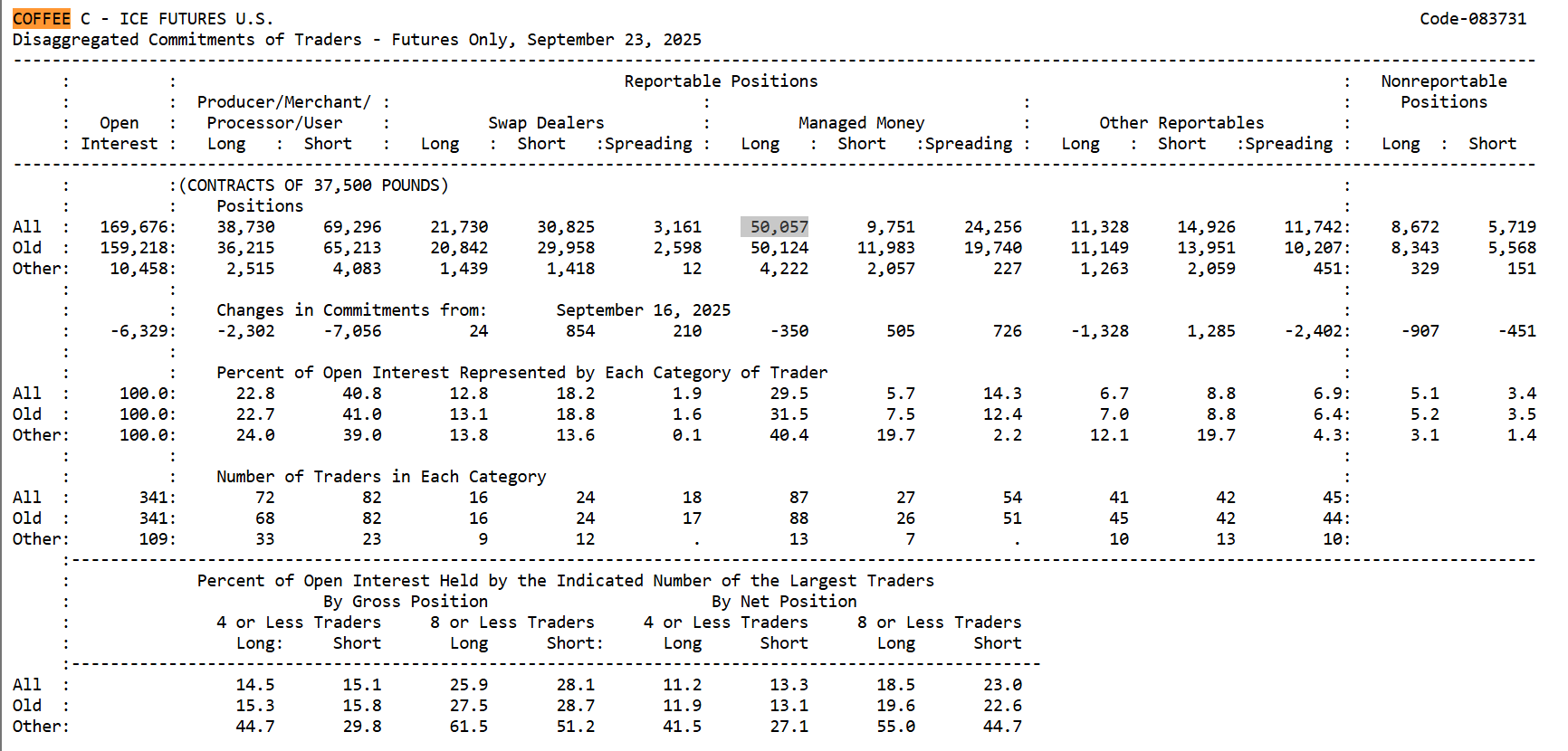

Just as in other futures markets, we can analyze the different participants driving prices of the benchmark for Arabica coffee, which is the Coffee C Futures offered by ICEUS. Diving into the latest Commitment of Traders report, we see the following statistics:

The majority of the open positions in the Producer/Merchant/Processor/User category are short, hedging against the risk of price dropping. These positions are thus very likely to be held by coffee farmers. Another interesting category to analyze is Managed Money; these are the hedge funds and mutual funds that have done meticulous research on the fundamentals of coffee and are in this situation convincingly long.

Note: The Commitment of Traders report is relevant regardless of the instrument you use to trade Coffee. CFDs are constructed to track prices of futures contracts; thus, analyzing the behavior of market participants on the futures market is directly relevant to CFD prices.

Trading the Arabica/Robusta spread: A unique opportunity

A unique non-directional strategy involves trading the price difference between Arabica and Robusta, known as the Arabica/Robusta spread. As Arabica is the premium, higher-quality bean, it naturally commands a higher price. The primary driver of changes in this spread is global macroeconomics, particularly shifts in consumer purchasing power. During periods of increasing inflation or economic downturn, consumers often switch from premium Arabica to the cheaper Robusta variety.

This opens up the opportunity for sophisticated relative value trades. A trader might consider structuring a position (e.g., long Robusta and short Arabica) to speculate on the widening or narrowing of the spread between the two types, without opening themselves up to the directional risks of a single direct position.

Conclusion

The coffee market offers a dynamic environment for traders, presenting opportunities driven by fundamental insights. By integrating factors such as currency movements (BRL/USD and VND/USD), monitoring certified stock levels, trading the Arabica/Robusta spread, and analyzing the structural positioning revealed in the CoT report, retail traders can develop comprehensive strategies.

Furthermore, the market's inherent volatility and inclination for sharp price spikes, particularly in response to geopolitical and climatic news, may favor trend-following or breakout approaches.

Ready to trade your favourite hot drink?