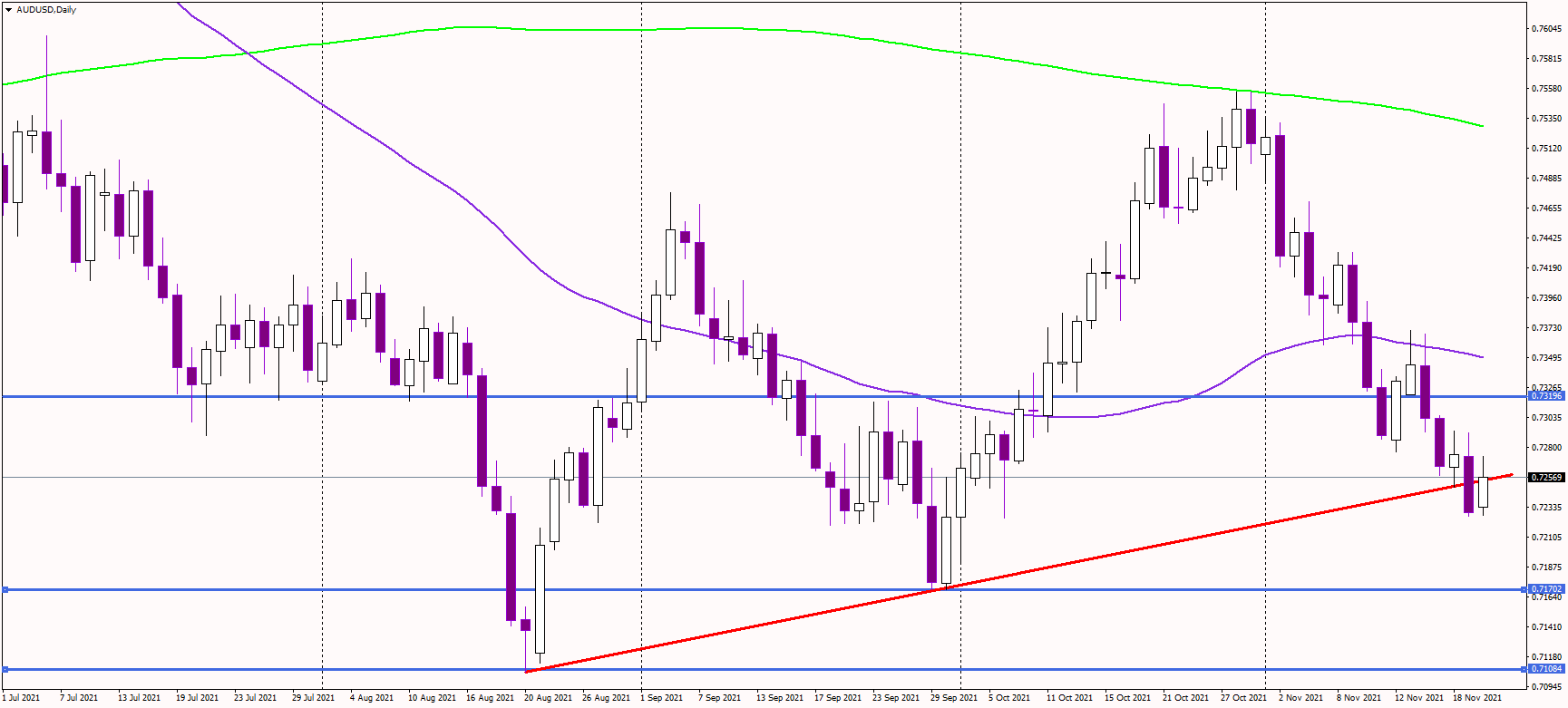

The Australian dollar surged half a percent Monday as the USD retreated, sending the AUDUSD pair to 0.7260 as bulls are trying to defend the essential ascending trendline from August and September lows.

The mentioned trend line is currently near 0.7260, and it was already broken to the downside on Friday, but the bulls managed to push the Aussie back above it. Therefore, it remains valid, but we need to see a rally soon.

Otherwise, risks are skewed to the downside as the bearish pressure remains fueled by the divergence between the Fed and RBA monetary policies.

In the downside scenario, the short-term support could be at Friday's lows of 0.7230, with the next target at September lows at 0.7170 and August lows near 0.71.

Alternatively, if a rally occurs, the next resistance could be found at 0.7320, where previous lows are. Then, in case of a bullish breakout, the medium-term uptrend might be renewed, with the immediate potential toward 0.74.

The Fed funds futures indicate the Fed first rate hike should come July 2022, and the following rate increase is expected by November 2022, possibly helping the USD over the next weeks.

Finally, several FOMC members will speak this week, possibly reiterating the hawkish mood and supporting the greenback.

AUDUSD daily chart 3 PM CET