The EURAUD cross rose sharply in November as stock markets corrected lower due to Omicron fears.

However, those fears are long gone, and US indices returned to their all-time highs, sending EURAUD lower and halting the immediate uptrend.

At the time of writing, the cross was trading somewhat higher on the day, rising above the 1.58 threshold ahead of the US session.

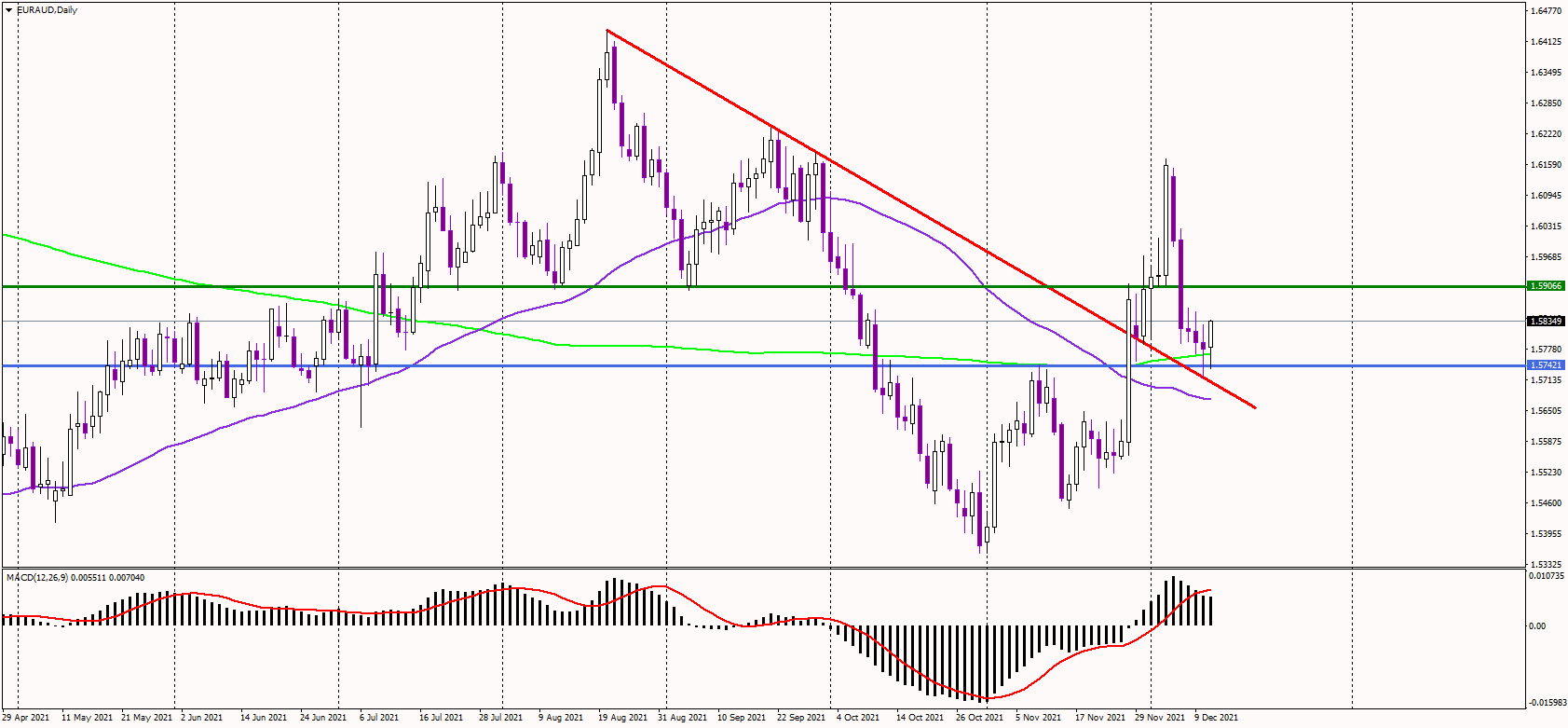

The price had dropped to the 200-day moving average (green line), currently near 1.5780, but it has managed to bounce off that level. Additionally, the broken, bearish trend line is circa in the same area, reinforcing the importance of the support near 1.5780.

As long as the price trades above it, the medium-term outlook seems bullish, meaning we should see more risk-off flows. The next target for bulls will likely be in the 1.59 area, where previous lows are.

Alternatively, a failure to stay above 1.5740/5780 could lead to a sharper decline, targeting the 50-day average (purple line) at around 1.5670.

Volatility is expected to be elevated this week as both the Fed and the ECB decide about monetary policy, moving the main currency pair EURUSD.