Gold (XAU/USD) could be named the most iconic financial asset in the world. Its deep integration into financial markets and its long, rich history require an in-depth understanding for anyone looking to trade this precious metal effectively. In this guide, we'll walk through the key fundamental and technical factors you need to master to successfully navigate the gold market.

Trading Gold through Contracts for Difference

Before diving into the specifics of gold, a solid understanding of how CFDs work and how they differ from buying futures contracts is required. These are some of the key features of trading through a CFD:

- A CFD is a cash-settled derivative. This means you never physically buy, sell, or take delivery of any goods. You are speculating on a contract that is made to track the prices of gold futures in major markets. Using CFDs thus allows you to speculate on prices without ever having to worry about rolling over a futures contract or undertaking physical delivery.

- CFDs allow you to use leverage, enabling you to use your capital more effectively. Using leverage wisely allows you to hold multiple positions at a time without tying up all your capital in just one asset. It also allows you to size up positions and potentially make significant profit from intraday swings that would otherwise achieve only a small percentage gain. Leverage is a tool; when used wisely, it can amplify potential returns, but if used without understanding, it can also increase the size of losses.

- Unlike a physical investment, holding a CFD position past the daily market close typically incurs an overnight financing charge (or 'swap fee'). This cost makes holding positions for extended periods less profitable. Therefore, the strategies discussed below are suited more for short to medium-term trades instead of longer-term investments.

Gold Fundamentals

Gold as an Inflation Hedge

Inflation is one of the few financial realities that affects everyone, and its persistent rise makes protecting your purchasing power more important than ever. This drives the ongoing search for assets that can shield wealth from the effects of inflation and currency devaluation.

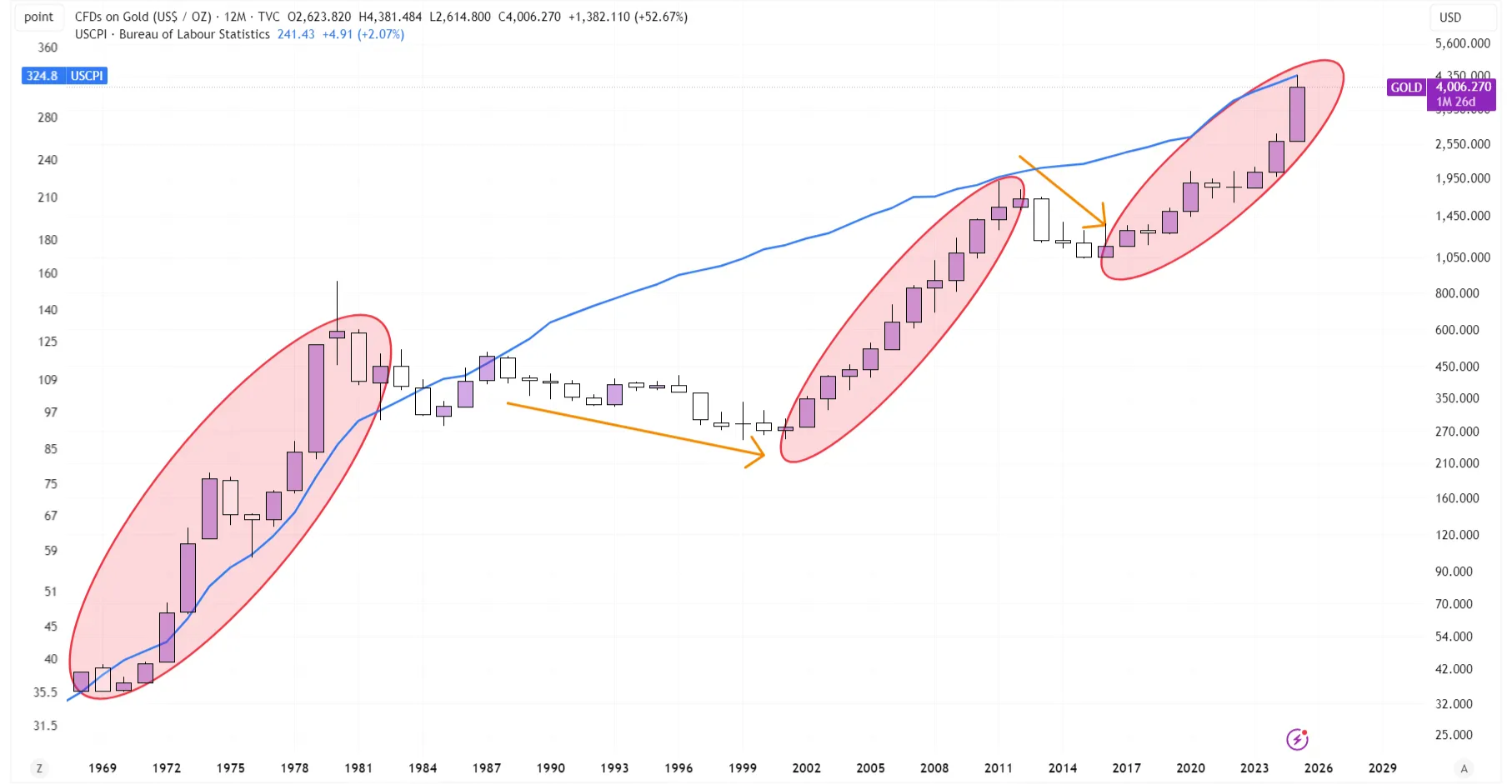

Gold has long been a popular choice in this pursuit. But how effective is it really as an inflation hedge? Let’s take a closer look at the chart below, which compares Gold prices to US inflation:

A 12-month Gold Chart since 1968, overlayed with US CPI

Assuming someone bought Gold in 1968 and is still holding it today, they would have the same purchasing power as at the time of purchase. On the surface, this suggests that Gold is an effective inflation hedge—but it requires a multi-decade outlook, unlike stocks or bonds, which are typically assessed over a multi-year horizon.

This very long time horizon is necessary to offset the multi-year drawdowns Gold has experienced twice over the past 50+ years. Entry timing also plays a critical role. For example, 1980 marked a peak in Gold prices, which were not surpassed until 2008. During this period, inflation rose by 180%, and it wasn’t until 2024 that this hypothetical investor would have reached breakeven in real terms.

These dynamics weaken the long-term case for Gold purely as an inflation hedge. However, this article isn’t focused on Gold as a long-term investment; it explores how it can be traded. In this context, there is potential for an edge.

While pure inflation is not always a leading indicator for Gold prices, research shows that inflation surprises can be highly effective at predicting price increases. A study by Goldman Sachs examining PCE Inflation surprises from 1970 to 2024 found that for every 1 percentage point of inflation surprise, precious metals—including Gold as the largest component—rose by 5.2 percentage points.

This suggests that instead of monitoring raw inflation data, traders should focus on inflation expectations. When expectations rise persistently, institutional interest in Gold tends to increase, which acts as a strong bullish force on prices.

Real Yields and Gold prices

To continue on our ever-important topic of inflation, we’re going into interest rates. Rather than look into how nominal yields affect Gold prices, it’s more important to account for inflation and consider the link between real yields and gold prices.

Conventional wisdom tells us that if real yields rise, gold prices should drop. And this reasoning makes perfect sense: Gold doesn’t offer yield, bonds do, so higher real yields (returns after inflation) would only logically make bonds more attractive and gold less so.

But let’s check if this is actually the case:

Gold prices versus inverted Real yields

This chart has already been simplified for easier analysis. In theory, the inverted real yield suggests that the yellow and black lines should move together: higher inverted real yields (or lower real yields) generally correspond to higher Gold prices.

However, the relationship appears less straightforward than expected. Between 2009 and 2020, the connection was quite clear, but it seems to have temporarily broken down since then. As real yields spiked, Gold was expected to fall—but instead, it continued one of the strongest bull runs in its history.

This illustrates that not only is the simple inflation-to-Gold relationship often inconsistent, but the real-yields-to-Gold relationship can also be volatile. Perhaps the next factor we examine will provide a more reliable structural guide.

Gold vs DXY

It makes sense that since Gold is priced globally in Dollars (XAU/USD), a stronger Dollar relative to other fiat currencies should exert downward pressure on Gold prices. It’s important to think critically and assess this relationship for ourselves:

Gold prices compared with the DXY (US Dollar Index) on the Weekly Timeframe

Looking at the charts, the inverse correlation between Gold and the DXY (US Dollar Index) holds up much better. Each of the marked tops in the DXY often coincides with a local bottom in Gold prices. However, the link seems strongest from one direction:

- When DXY drops, there’s a strong tendency for Gold prices to rise

- When DXY rises, Gold does not seem to be affected as strongly, and the relationship is weak

This could be due to Gold’s underlying macro uptrend, so let’s switch to the Monthly chart and reanalyze:

Gold prices compared with the DXY (US Dollar Index) on the Monthly Timeframe

The link seems to be stronger, although we can still observe that the DXY has to rally in a sustained and aggressive manner for Gold prices to durably trend lower.

This dynamic is easily explained by a key structural force: Fiat currencies are constantly being debased. Central banks typically target an inflation rate of 2%. Assuming all major countries maintain this target (they are generally above), gold prices will automatically experience a structural upward bias due to the debasement of the currency in which it is measured (USD), even if the Dollar's worth remains constant relative to other fiat currencies. This creates a structural bullish bias for gold, similar to equities, albeit less pronounced.

Gold/Equities correlation: Is it a Safe-Haven Asset?

Another core narrative surrounding gold is its role as a safe-haven asset; the idea that when stocks decline, gold prices will remain stable or even increase. Academic research has challenged this point, showing that from 1975 to 2012, gold was just as likely to go up during months with negative returns for the S&P 500 as it was to go down.

The above chart proves these academic findings and shows that when the S&P 500 considerably drops, gold isn’t a reliable safe-haven asset.

Fundamentals: Conclusion

We’ve found that neither real yields nor simple inflation metrics are consistently effective at dictating Gold prices in isolation. The DXY offers a better directional cue, but it can still lag, and the correlation isn't perfect.

All of this might make it seem like these fundamentals are irrelevant in assessing Gold’s direction, so we’re better off just ignoring them. In reality, the opposite is true. We’ve only assessed each of these factors alone and compared them with Gold prices, whereas in reality, all of them were influencing Gold prices simultaneously.

Your edge as a trader lies in understanding the whole story: knowing the potential effect of each factor on gold prices and, based on the totality of the evidence, forming a conviction on the likely direction of the market.

At times, different fundamental factors will be conflicting, leaving you with no clear idea of what to do. That’s perfectly fine. Success in trading isn't about constant activity; it's about patiently waiting until you have a strong read on the market, and then acting decisively. As long as major institutional investors and other traders watch real yields, inflation, and dollar strength, they will drive prices. As a proactive trader, you should watch these fundamentals like a hawk and strive to draw conclusions before the wider market does.

Supply/Demand Dynamics

Supply: How much Gold is Being Mined?

There remains a significant amount of gold supply yet to be extracted. Currently, there are about 216,000 tonnes above ground, but an estimated 186,000 tonnes remain underground. If a substantial portion of this untouched supply were suddenly to hit the markets, it would almost certainly drive prices down.

However, of that 186,000 tonnes, only about 55,000 tonnes are classified as reserves that are economically viable to extract at current prices and costs. The rest will only gradually become cost-effective to mine as either gold prices rise or production costs in real terms decline. At the current rate of extraction, about 1.5% of the above-ground supply is being added annually. While this increasing supply is a bearish force, its effect on price is generally smaller.

Demand: The De-Dollarization

Over the past decade, countries have been trying to move away from the U.S. Dollar hegemony. Big purchasers have been China, Turkey, and Poland, notably all non-Western countries that favor gold as a neutral store of value that has withstood the test of time.

These central bank purchases are a major piece of the demand puzzle. It’s highly recommended to closely monitor these purchases and assess whether they’re expected to continue, as these central banks are largely price-insensitive buyers.

Because their primary goal is diversification away from other fiat currencies, they are much less sensitive to price changes. They continue to create bullish pressure even as prices strongly increase and are less likely to be deterred by bear markets, which, in turn, helps to keep a floor under prices. To anticipate future gold demand, it is crucial to not only monitor financial markets and macroeconomics but also have a basic understanding of geopolitics.

As Eastern countries pivot away from Western-centric financial systems, their demand for Gold is likely to continue increasing, driven by the desire for strategic diversification. Therefore, monitoring the Western-Eastern relations, especially the ever-changing U.S.-China dynamic, can serve as a leading indicator for central bank gold purchases, and by extension, for gold prices.

Important News Releases

As an active trader, there are a couple of absolutely key news reports that drive volatility in Gold prices. It’s wise to use the Axiory economic calendar and mark any of the news events we’ll be talking about here in your calendar. Around these windows, volatility is multiple times higher than usual, and it’s thus very easy to quickly lose money.

FOMC Meeting

As the leading world economy, the U.S. Federal Reserve’s (Fed) interest rate decisions have the highest significance of any macro event. Even though the long-term case for gold as a perfect inflation hedge is debatable, it remains perceived as an inflation hedge by many investors, and that collective market perception is all that truly matters for short-term price movement.

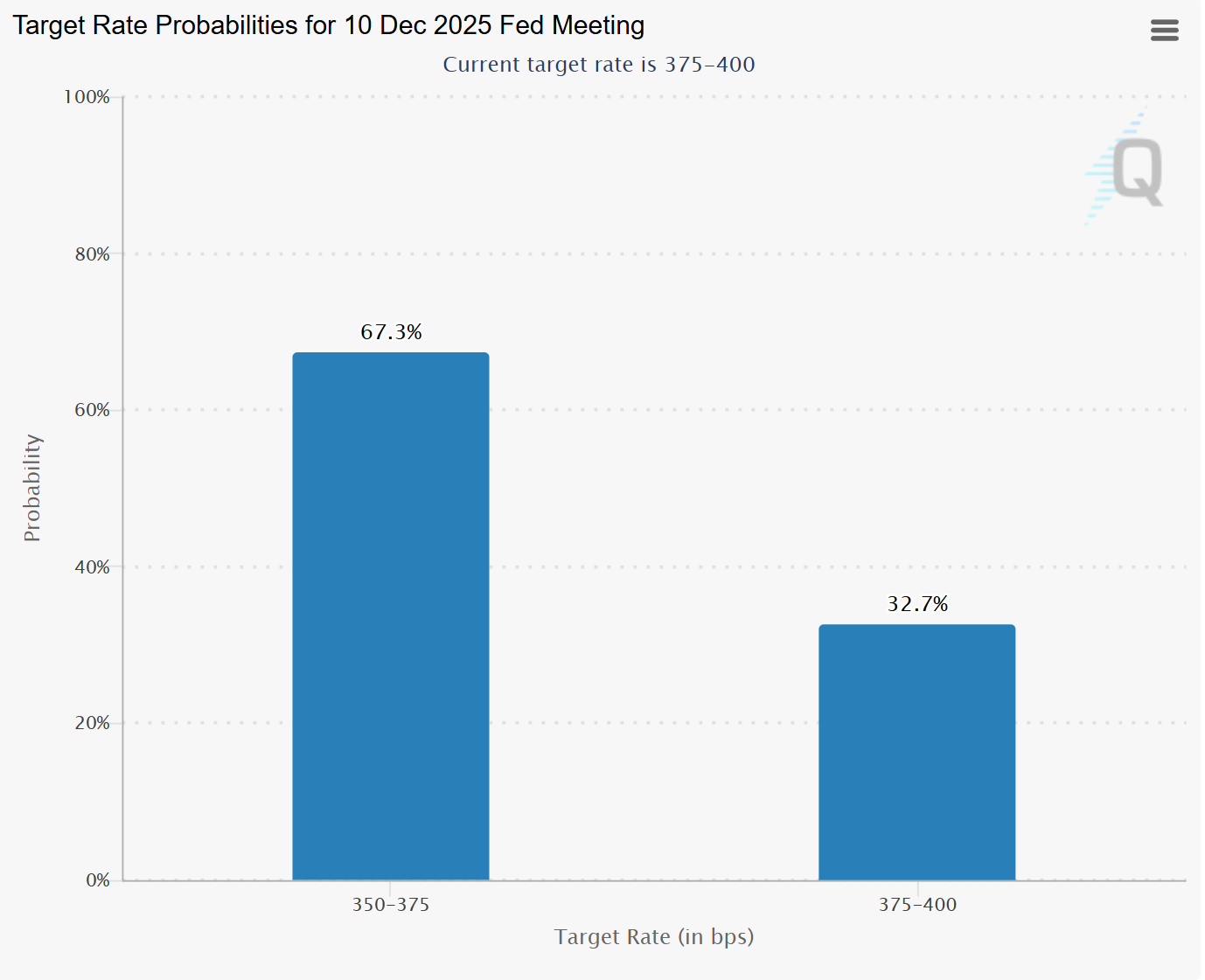

Ahead of any Federal Open Market Committee (FOMC) meeting, it’s vital to assess the odds of the interest rate decision, i.e., what has the market already priced in? The most effective tool for this has traditionally been the CME Group’s FedWatch Tool, which tracks prices of 30-Day Fed Funds futures. These boast high accuracy because they allow traders to profit directly from assessing Fed direction.

Target Rate Probabilities based on CME Fed Funds Futures

More recently, prediction markets, such as Kalshi, have gained traction and have proven to be extremely accurate at predicting future events. Because of this, it now makes sense to not only check the CME tool but also look at prediction markets to establish a clear expectation of the central bank's action.

FOMC Rate Probabilities on Kalshi

Once you've set your baseline expectations, you can move forward toward the FOMC meeting itself. In this particular example, there’s a lack of consensus on what will happen, with 66-67% odds of a 25bps rate cut, and 32% odds of the Fed maintaining the rate.

Now that we’ve set our baseline expectations, we can move forward towards the FOMC meeting itself. Let’s assume the same probabilities persist at the time of the meeting, and the Fed decides to cut the funds rate by 25 basis points. Since this action wasn’t completely priced in, we would rationally expect prices to rally upon the announcement.

However, financial markets aren’t quite that simple. Instead, two other nuances will influence market behavior as well:

First off, any FOMC Meeting is immediately followed by a press conference by the Fed chairman. What is said during this press conference is as crucial as the interest rate decision itself. Since financial markets are always forward-looking, any unexpected dovishness (loose monetary policy, lower interest rates) or hawkishness (strict monetary policy, higher interest rates) can lead to aggressive swings in prices immediately following the press conference.

Secondly, there’s pre-meeting positioning. Right before major news events (like the FOMC Meeting), market makers often pull their orders to protect their books. This causes small orders to create much bigger, volatile price swings, often resulting in an indecision candle wicking to both sides as the price aggressively tries to find the newly established value. After this initial liquidity shock, orders gradually return to the market, and we typically see price steadily absorbing the new information over the next 24-48 hours, offering opportunities for traders with a good read on the positioning flow and orderflow dynamics.

Non-Farm Payrolls (NFP)

We’ve established that interest rates are the most important macroeconomic factor influencing gold prices. It thus makes sense to watch the two core mandates that drive the Fed’s monetary policy: inflation and employment. Let's start with the latter.

Non-Farm Payrolls serves as the most important monthly employment data release. It calculates the net change in jobs based on a detailed monthly survey. The fact that this data stems from actual surveys rather than purely statistical estimations is what makes NFP so reliable. NFP causes significant volatility because the numbers are immediately interpreted into how they will impact the likelihood of future interest rate adjustments. Strong NFP usually suggests a strong economy, potentially leading to higher rates (bearish for gold), while weak NFP suggests the opposite (bullish for gold).

Consumer Price Index & Personal Consumption Expenditure

The second part of the Fed’s dual mandate is keeping inflation under control. Additionally, major institutional investors watch inflation closely, as a stagflationary environment (stagnating economic growth with high inflation) would make gold the ideal asset to move capital into.

This makes the Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) crucial in assessing not only the Fed's monetary policy path but also the interest of institutional capital in gold.

Both measures aim to quantify inflation but differ slightly in their methodology. CPI is the better-known and most universally recognized inflation indicator. However, PCE is the measure preferred by the Fed and is generally considered slightly more accurate because it looks at a broader range of spending and accounts for consumer substitution between goods (e.g., if the price of beef rises, a consumer might buy chicken instead, which PCE captures).

Conclusion

This article has guided you through the complex fundamental landscape of Gold trading. With a plethora of sometimes conflicting correlations, trading this asset can be tricky since its appeal to investors is dependent on so many factors. The most important drivers are the overall risk sentiment, inflation surprises, US Dollar strength, and real interest rates.

By combining these factors with the Supply and Demand dynamics, traders understand the current bull case for Gold, which is faltering economic trust, along with low real yields and significant demand from central banks.

Ready to apply your knowledge of Gold’s key fundamentals to track changes in the market and identify emerging opportunities?