The bullion is up for four consecutive days, rising nonstop since the latest Fed's decision. At the time of writing, it was 0.3% stronger, trading at around 1,830 USD, jumping more than 3% from its last week's lows.

As (real) yields dropped sharply over the previous days, the greenback also fell, supporting silver and gold. Traders are starting to outprice rate hikes in 2022 as the Fed funds futures have pushed back the likely date for rates lift-off from around July next year to September or October.

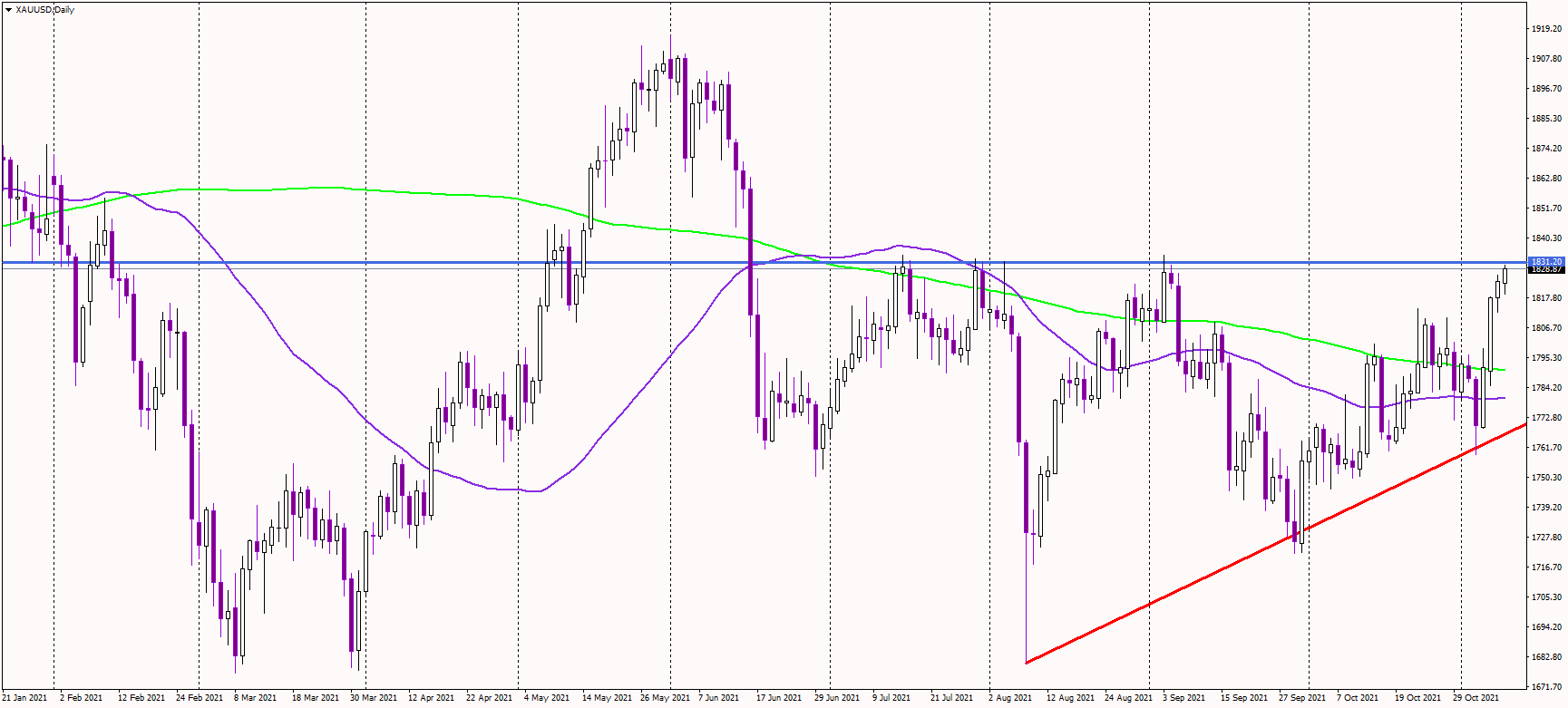

Gold is now trying to breach the critical resistance of 1,830 USD, where it has failed the last three times since June. Jumping above it would likely kill large stop-losses of short positions, possibly sending the metal sharply higher and confirming the medium-term uptrend.

In that scenario, bulls' next target would be at May highs near the 1,900 USD level.

Alternatively, if the resistance is defended again, gold might decline toward the psychological level of 1,800 USD. Below that, buying orders could be at the 200-day, 50-day moving average or at the ascending trendline near 1,770 USD.

Should US yields continue to decline, gold might remain bid, and the resistance will likely fall in that scenario.

Gold daily chart 3:00 PM CET