The Canadian dollar was the only major currency stronger against the greenback today, and the USDCAD pair was down 0.2% at the time of writing, trading at around 1.2420.

Traders paid attention to US inflation data for October. US Consumer Prices (CPI) soared 6.2% YoY in October, way higher than the 5.9% YoY expected and accelerating from September's 5.4% YoY - the highest since June 1982.

The US dollar initially surged after the data but was slowly fading as the dust settled in. The Fed is in no hurry to raise rates, and inflation will slowly but surely, destroy the value of the US dollar.

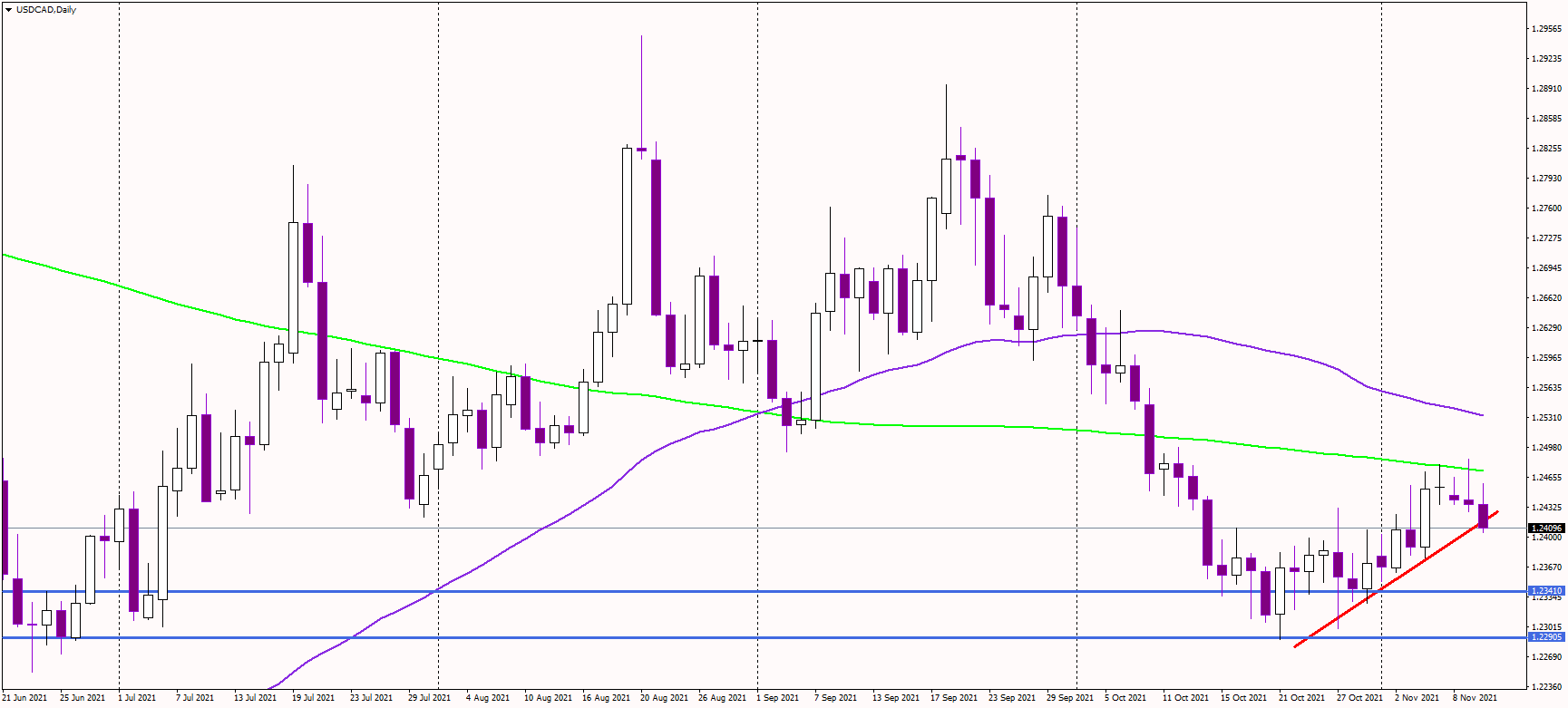

Earlier in the week, the USDCAD pair retested its 200-day moving average near 1.2470, but the resistance was defended, and bears regained control of the market. Therefore, the latest pullback was only a technical bounce, but the medium-term downtrend remains intact.

It also looks like the pair has dropped below the short-term ascending trend line, confirming the short-term bearish bias. The next target is expected at 1.2340, followed by the previous swing lows near 1.2290.

Alternatively, the USD needs to rise above 1.2430 to cancel the immediate bearish threat. Only a break above the 200-day average could change the medium-term trend to neutral.

USDCAD daily chart 3 PM CET