False breakout examples

Let’s discuss some of the fakeout examples to see how they occur in live markets.

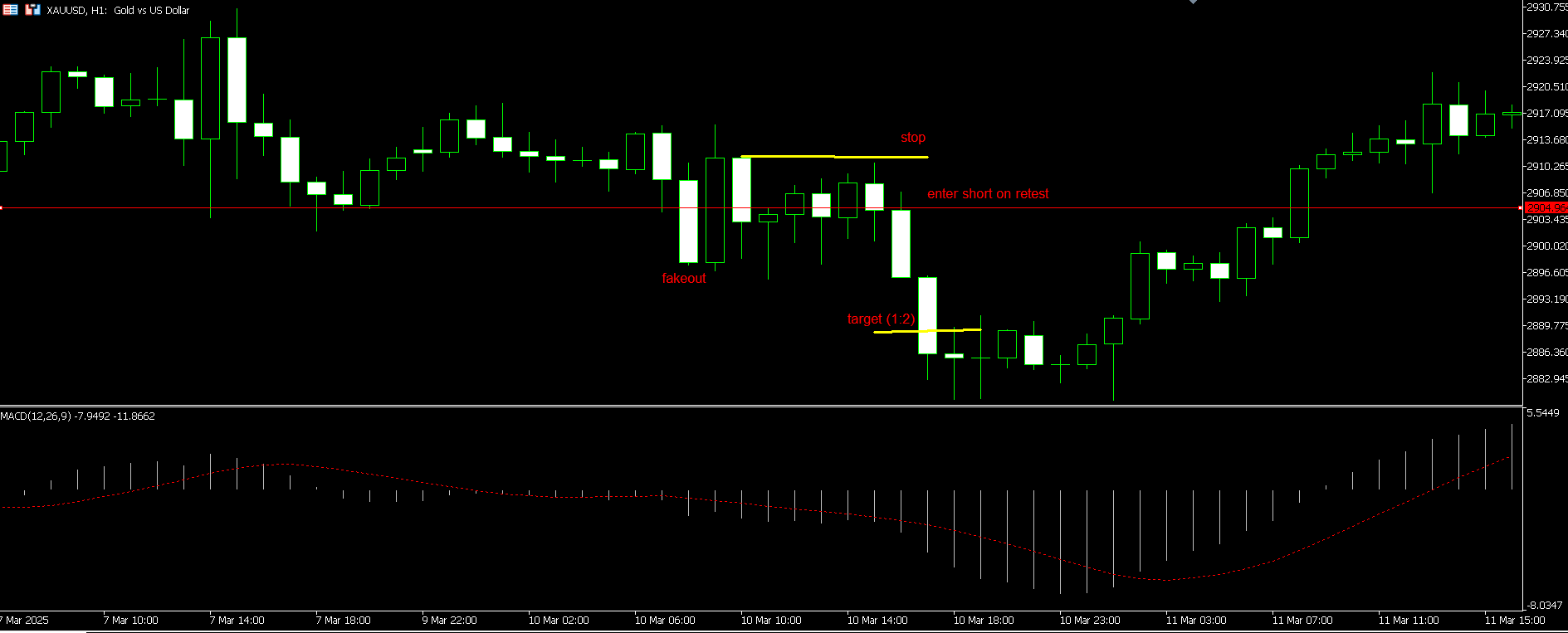

The first one is a fakeout that happened on Gold CFD in the 1-hour timeframe. The move was started by a huge bearish impulse that broke the level and closed below it. However, the ADX was below 20, indicating that there was not much momentum behind this move, which was confirmed later when the price reversed on the next candle, crossing the support zone and closing above it. This case is complicated as the price managed to close below the support which could trap many inexperienced traders to enter on the short side because of FOMO (fear of missing out). Experienced traders would notice that ADX and other indicators did not indicate much momentum.

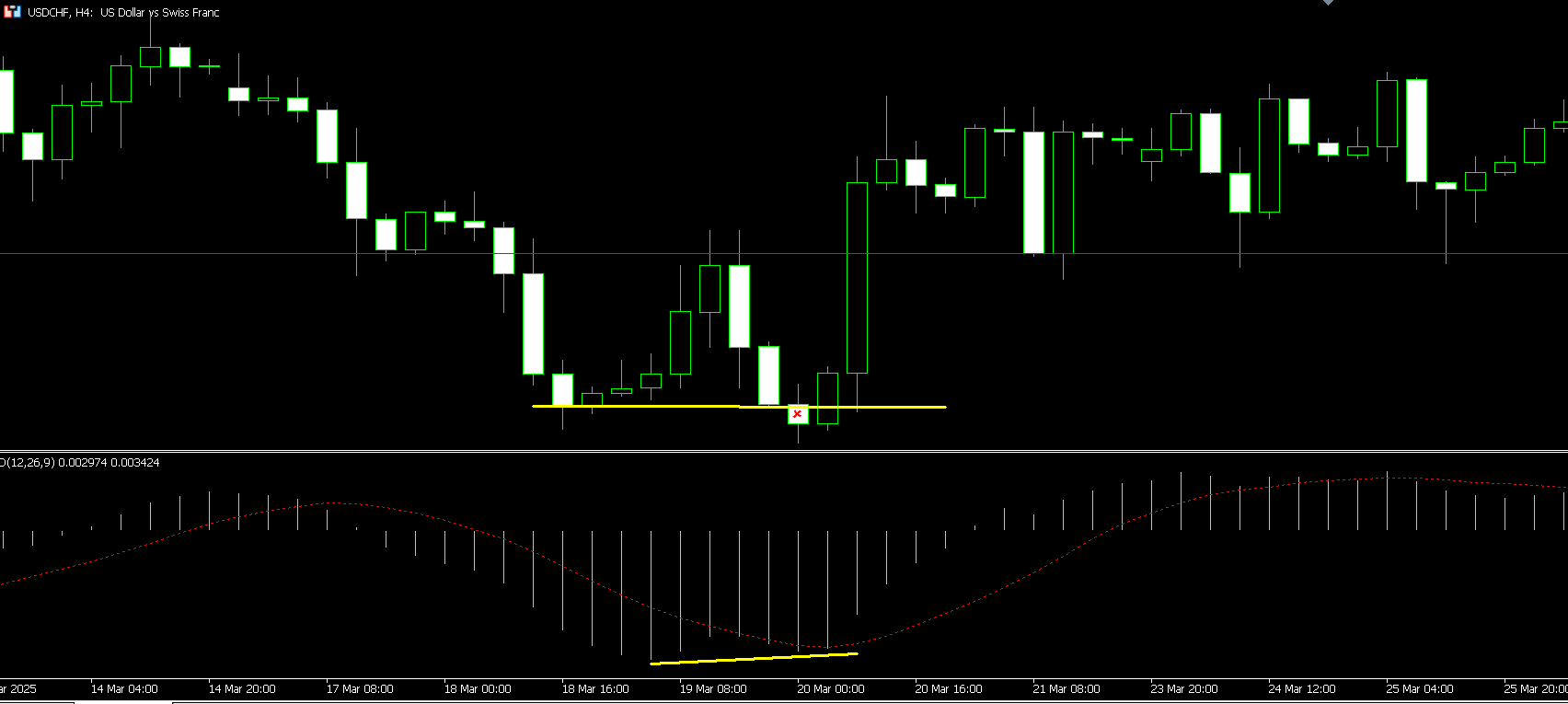

The next example occurred on a USD/CHF (U.S. Dollar against Swiss Franc) 4-hour chart where the price printed a bearish candle slightly below the lowest price (support zone). However, the MACD histogram showed that this price impulse was actually weaker than the previous impulse, indicating that this could be a fakeout. This was later confirmed by the price reversing upwards and moving all the way up to previous resistance levels.

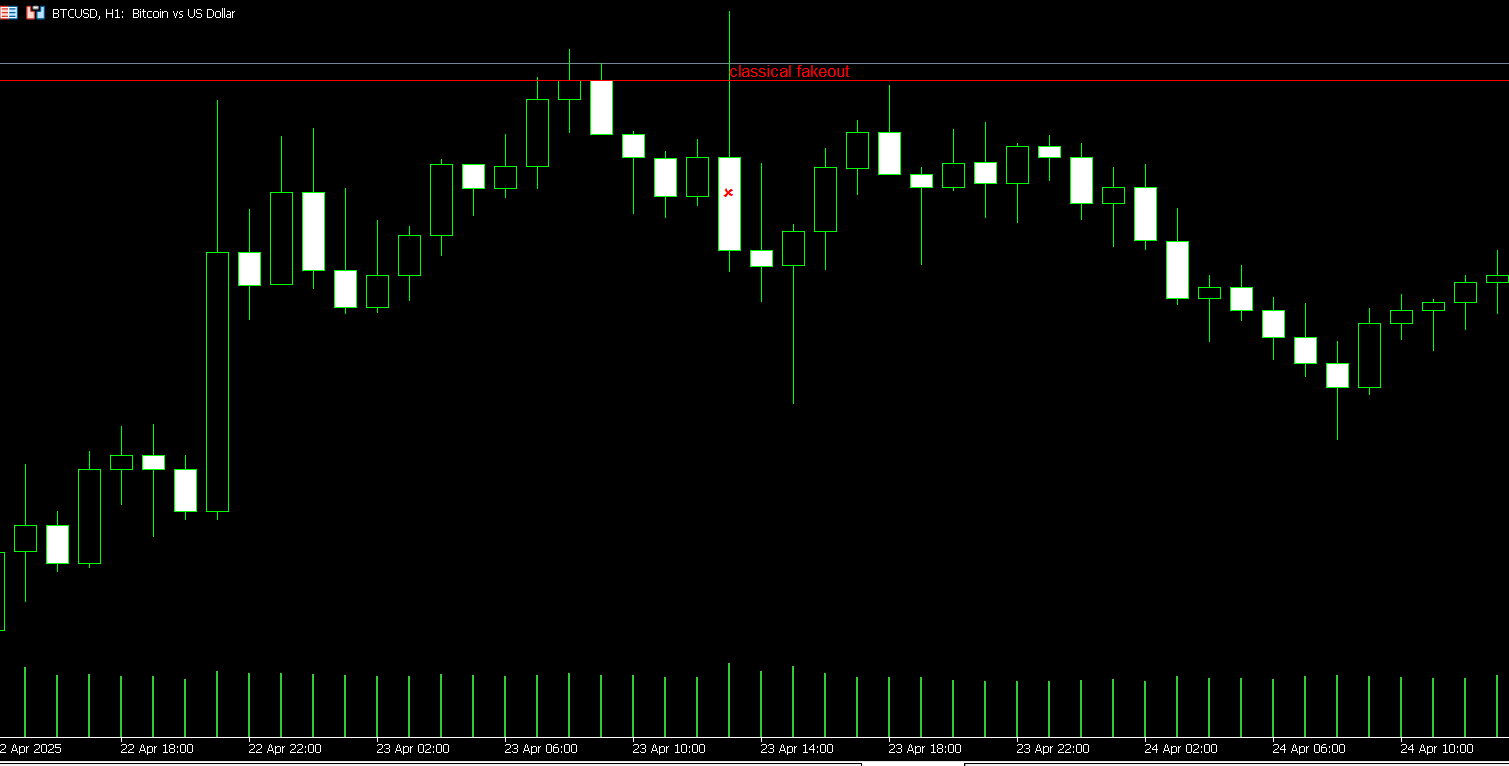

While the abovementioned fakeouts could only be detected via indicators such as MACD and ADX, the following one is a classical fakeout setup. The price on the 1-hour BTC/USD chart started to rise rapidly and it broke the resistance level without an issue only to immediately reverse and close below the resistance level. This is why traders should wait and see what the price does after breaking the zone. This setup is easier as it also shows no volume spike during the breakout, indicating that there were not enough buyers behind the move to support the price action with strong volume.

How to trade and avoid fakeouts

Seeing a false breakout in trading might befrustrating for beginner traders, but there is a way to counter and use false breakouts to catch valid trades. One of the best methods is to wait for the price to break the level, then retest the level and only enter when it decides where to move.

The first step is to try not to enter right away when the breakout happens if it's not supported by an indicator and if it does not close beyond support and resistance levels. Waiting for several candle closes and retests remains the best approach where the trader avoids fakeouts and catches valid breakouts. Reducing fakeouts and waiting for the best setups at the pullback, enables seasoned breakout traders to reduce false signals and increase their win rate, which is important for reducing losses.

In the XAU/USD (gold) 1-hour chart, the price broke out of the level then it went back but started to move around the support zone and then continued in the direction of a breakout after retesting. Traders could enter after gold tested the support zone and it became a resistance level. As the price went down, traders would ride it for profits.

Entering against breakout

Many traders also trade against breakouts and they target the midpoint of the prior range with a minimum 1:1 risk-reward ratio. Surely, having a higher risk-reward ratio such as 1:1.5 and beyond would make more profits but also more losing trades. This strategy enters when the breakout happens and the price fails to close beyond the support and resistance levels, capitalizing on fakeouts. A lower risk-reward ratio will mean a higher win rate, so, there is a tradeoff here.

This strategy is effective when indications of a false breakout are clearly visible. Traders should try to trade only clean and well-tested levels where the price has bounced multiple times. Zones with more touches typically are more solid and fakeouts happen frequently.

Risk management

In our false breakout examples, traders would lose money. Even when traders use other tools for confirmation, fakeouts can still occur, meaning it is mandatory to use strict risk management strategies.

The most important risk management tools are stop-loss and take-profit orders. The stop loss is crucial in Forex trading and traders should always set stop-loss to ensure the losses are cut early. There are many methods to set stop-loss like behind recent price swings or at a fixed distance from entry.

Another important way to manage accounts and ensure long-term success is to have realistic expectations and goals. Traders should aim to stay in the trading game long-term and protect their capital by using stop-loss and take-profit orders. Position sizing and not risking more than 2-3% of your account on any single trade is another effective way to minimize risks and eliminate the risk of ruin. Even if your strategy hits the losing streak, by risking no more than 2-3% of your account, the losses will not be substantial.

Trading journals and constant reviews of your trading performance will ensure you are always in control of your trading performance. Traders should write down all their trades and later analyze them for insights to find errors and what could be improved.

Conclusion

False breakouts in Forex trading are frequent and occur when the price crosses the support and resistance level but fails to move forward and reverses. False breakouts or fakeouts are a serious challenge for breakout traders and by understanding their nature and meaning, it is possible to avoid fakeouts and minimize losses. Traders can spot fakeouts before they happen by analyzing volume and price action. Psychological drivers like FOMO coupled with low-liquidity spikes around news events, fuel fakeouts. Traders can distinguish fakeouts from true breakouts by analyzing price action: sustained closes beyond levels, rising volume, and momentum, typically indicate genuine breakouts while low volume usually indicates fakeouts. MACD, ADX, and RSI indicators can be deployed to analyze trader power behind breakouts and get early signs of fakeouts. Effective strategies include waiting for retests or trading against breakouts with a lower risk-reward ratio to achieve high win rates. Strict risk management using stop-loss and take-profit rates and journaling and analyzing all trades also contribute to successful fakeout trading.