The EURJPY cross has gone nowhere over the previous months, but it was 0.4% stronger on Friday, trading at around 129.40 and waiting for today's US job market data.

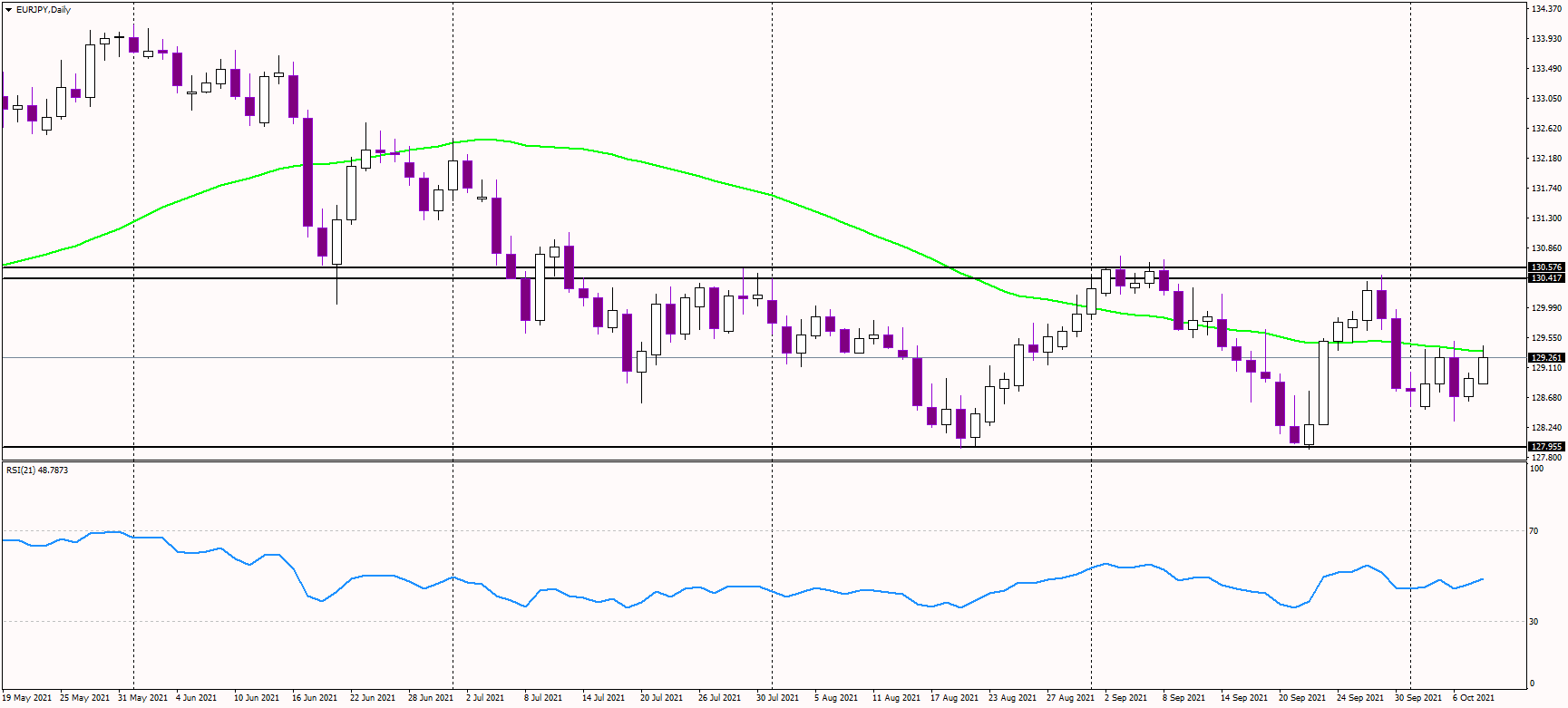

The euro remains stuck in a tight range - the upper resistance is in the 130.70 - 130.40 zone, while the support is seen at 128.00. As it has been trading between these two barriers since July, the medium-term outlook seems neutral.

At the moment, it is trying to jump above the 50-day moving average at 129.40. If successful, it will likely attack the mentioned upper barrier of the resistance zone.

Alternatively, a failure to get above the 50 DMA could lead to another decline, targeting this week's lows at 128.50 and afterward the essential 128 support.

However, once we see a break from the 130.70 - 128 zone, volatility should pick up and the cross might start another meaningful trend. Until then, it could be suitable for short-term traders.

Volatility is expected to be higher today after the US labor market data update, so investors should be cautious with their trading orders.