On Wednesday, the greenback continued to dominate the FX market, pushing the EURUSD pair below the August lows and trading near 1.1640, the level last seen in November 2020.

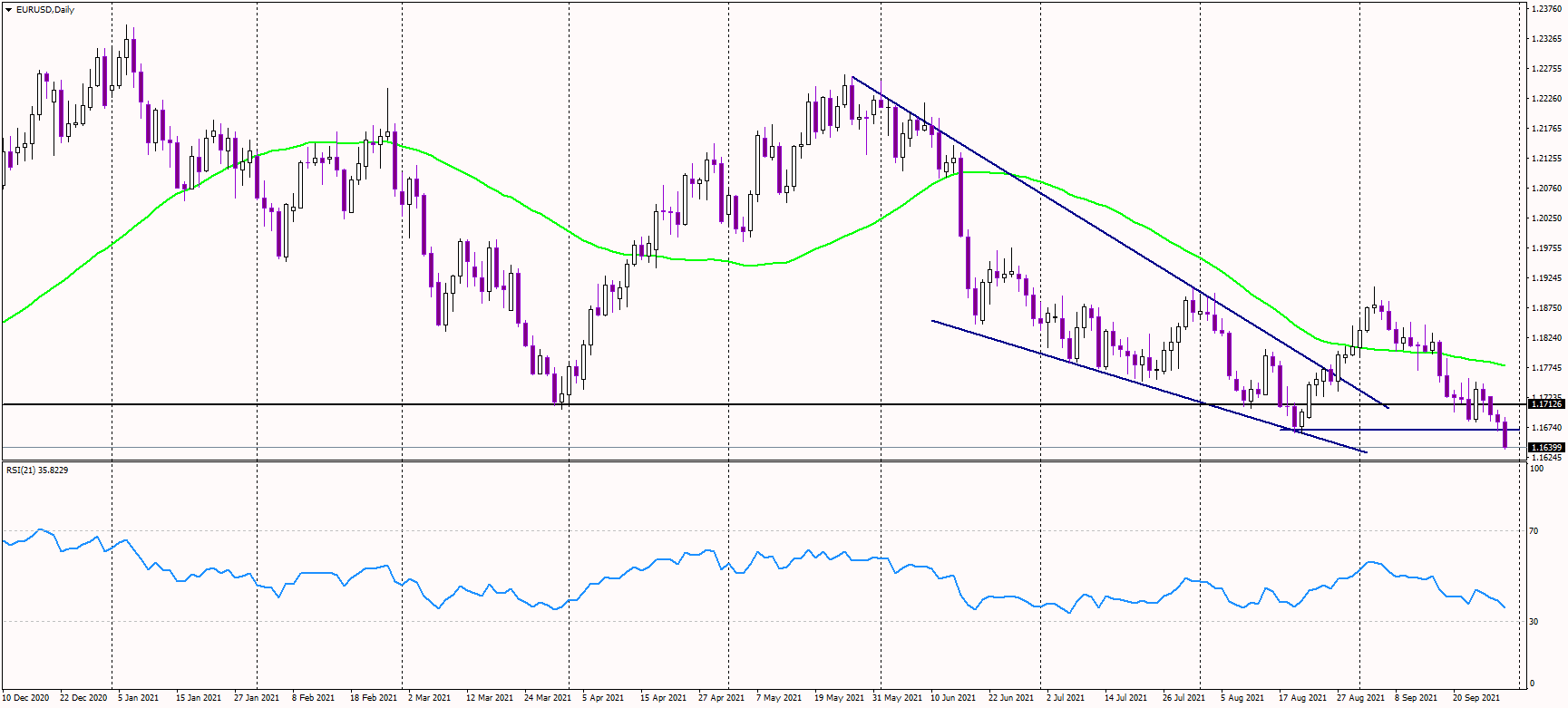

The recent falling wedge pattern has been invalidated, and as long as the euro trades below the August lows of 1.1670, the short-term bias seems bearish. Additionally, as long as the pair remains below March lows of 1.1715, the medium-term trend appears bearish too. Thus, rallies to these levels are expected to be sold.

The next target for bears now lies at September/November 2020 lows, located near 1.1610. If the euro drops below that level too, the long-term uptrend would be over, and bears might push the pair toward the pre-COVID highs at 1.15.

Overall, it looks like the Fed will need to be more hawkish than previously thought, judging from the soaring inflation, which in no way seems temporary. Therefore, traders are repricing their rates expectations. As a result, there is now a 50% chance of a rate hike in September 2022, up from 30% a week ago.

September 2022 is still a year from now, but if yields continue to move higher, the USD might be supported further.