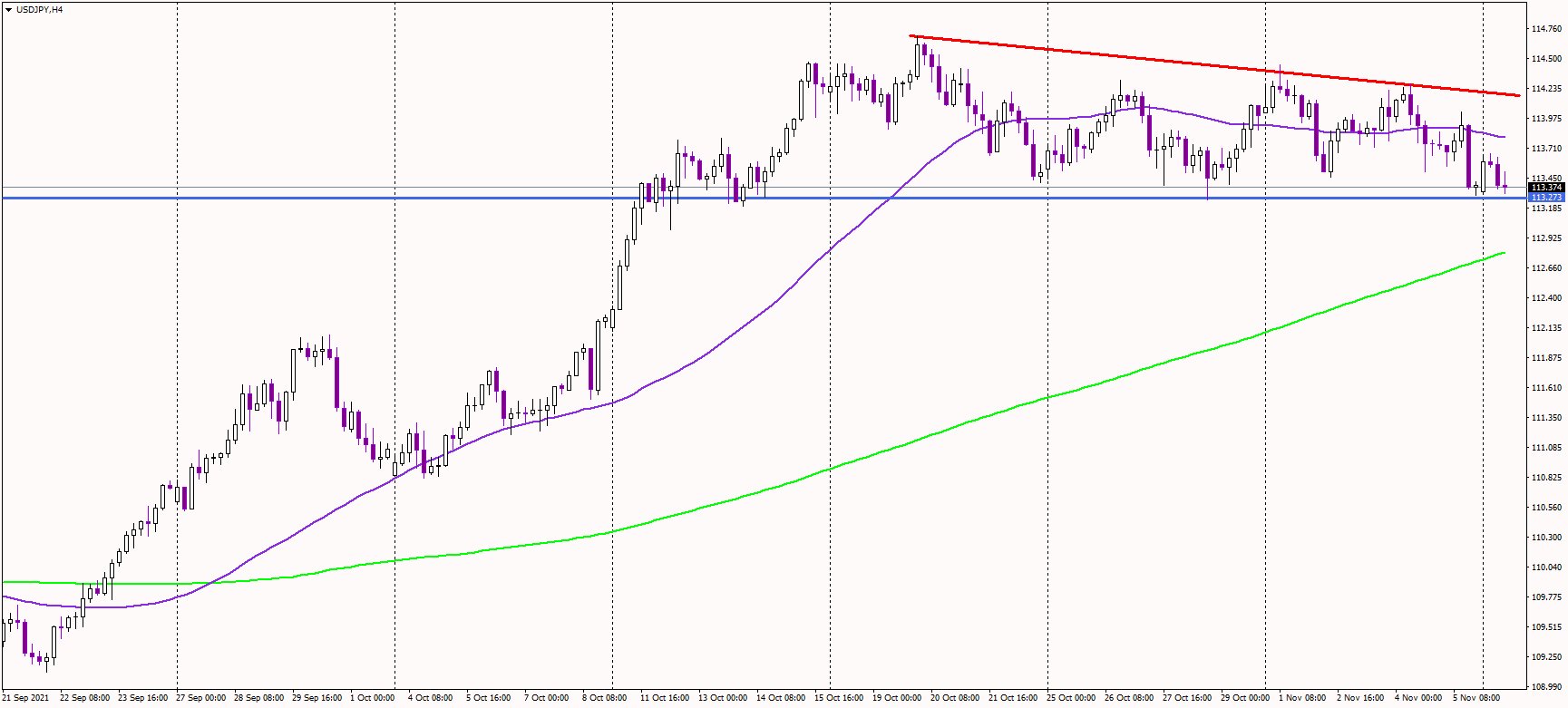

The USDJPY pair has been consolidating recently and has not moved anywhere over the previous three weeks. At the time of writing, it was trading flat, spotted at around 113.40.

So far, the greenback has ignored the plunge in US yields as markets have started to outprice possible rate hikes in 2022. Nevertheless, the USDJPY pair has held firm.

The key support is now located in the 113.20 area, and if not held, the current triangle pattern could become a reversal pattern, with a total potential of 150 pips. Thus, targeting 111.60 in the medium-term perspective.

Alternatively, the resistance is seen near the 20-day moving average at 113.80, and the greenback must climb above it to switch the short-term outlook to bullish again. Additionally, the descending trend line is seen near 114.20, and if the USDJPY pair rises back above it, the medium-term uptrend might be renewed.

However, considering the sharp decline in US yields, the bearish pressure could become dominant over the following days, primarily as the USD declined after better than expected Friday's payrolls.

USDJPY daily chart 3:00 PM CET