Pros and cons of the stochastic oscillator

As with any indicator or a tool, a stochastic system comes with its own unique set of pros and cons.

Pros of stochastic trading indicator:

- Sensitive to momentum - Reacts quickly to changes in price, useful for market momentum detection. Ability to spot reversals early.

- Simple overbought and oversold signals - oscillates between 0 to 100, provides overbought and oversold signals.

- Highly accurate when combined with other indicators - Works well with other indicators and tools, including but not limited to moving averages, RSI, etc.

Cons of the stochastic oscillator:

- Useless in choppy markets - It is known for generating multiple false signals when there is no trend, making it risky to use as a standalone indicator.

- Lagging - Although sensitive to momentum, it lags during fast price movements.

Because of these limitations, it is critical for traders to always use stochastic with other indicators or tools such as support and resistance levels to increase the probability of profitable trades. Stochastic divergences are especially powerful when combined with support and resistance or candlestick patterns.

Developing a Forex Stochastic Trading Strategy

To build a profitable strategy using a stochastic oscillator, traders need to follow strictly defined steps of applying the indicator to charts, selecting the timeframe and asset, and developing a risk management strategy. Backtesting and forward testing are also critical to ensure the strategy works in the real world.

Setting up the stochastic indicator

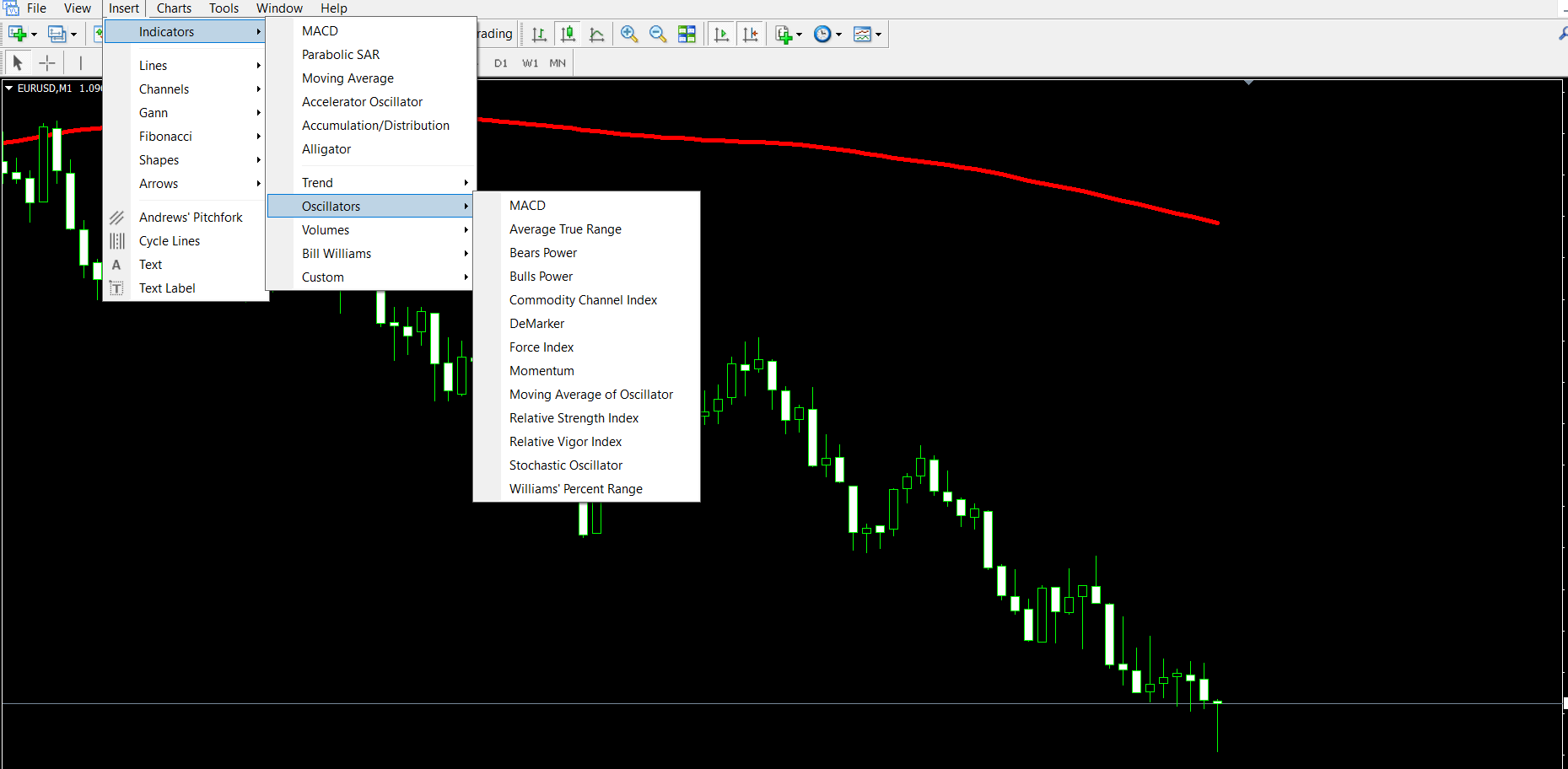

Apply a stochastic indicator to your preferred asset chart and edit its parameters. The default settings are 14,3,3, and it is advised not to change them in the beginning. Tweak settings only after mastering the indicator and understanding how it reacts to different market conditions. Here is how to apply the stochastic indicator to your MetaTrader 4 charts:

On your MT4 or MT5 platform, click on Insert → Indicators → Oscillators → Stochastic, click on the stochastic indicator, and the menu will pop up, where you can edit its settings and levels. The process of applying the indicator to the chart is exactly the same on both MT4 and MT5 platforms, which is very useful.

It is best to leave the settings untouched as it offers overall balanced parameters and only change them when you have experience with it.

Combining with other indicators

To develop a profitable trading strategy, it is important to combine the stochastic with other indicators. If you are planning to use stochastic overbought and oversold conditions as trading signals, ensure to add another indicator for confirmation. This can be a moving average, RSI, or basic support and resistance analysis.

Here is an example of a simple support and resistance stochastic trading strategy:

The price pulls back to the trend line after a strong trend, the stochastic shows an oversold level, and the price starts to reverse and continue with the established trend. This could be a perfect time for long entries, with the opposite being true for sell trades.

Risk management

Trading without a stop loss is the best way to blow up an account, and traders must always set stop loss orders. Now, the trick is to define a viable stop loss strategy that ensures your stops are not easy targets for the price. The best approach is to put it either behind the current support resistance levels or recent price swings, below recent lows on long positions, and above current highs when shorting.

Backtesting and forward testing

The only way to determine how reliable your strategy is is to conduct a thorough analysis of its performance first on historical data and then test it in live market scenarios on a demo account. Only after these procedures can a stochastic-based strategy be applied in live trading. Demo trading is also called forward testing, and it is a powerful tool to check the viability of the strategy.

Forex stochastic practical tips for real-world trading

Many traders fall victim to the fear of missing out, motivating them to enter positions early without waiting for confirmation. Another mistake is to enter on stochastic signals without some kind of confirmation. Using additional indicators, traders must ensure that the signals from the stochastic oscillator are valid.

When the stochastic oscillator issues a signal (oversold or overbought), do not rush to enter the trade. Instead, check another indicator, such as a moving average or RSI (whatever you use as confirmation), and ensure the confirmation indicator also agrees with the oscillator.

Here is a list of practical tips when trying to use a stochastic indicator in Forex profitably:

- Always confirm stochastic signals using additional indicators

- Practice on a demo account to ensure you have absolute mastery of your strategy

- Stick to your strategy rules to avoid impulsive decisions

- Never rely on any single indicator, including a stochastic oscillator

By following these simple tips, you can use the stochastic oscillator in your trading successfully.

Conclusion

In conclusion, the stochastic oscillator is a technical indicator in Forex trading that is used to measure momentum. It achieves this by comparing the user-selected asset’s current closing price to its historical range. A stochastic indicator is a nice addition to a trader’s arsenal of tools as it incorporates randomness, making it a viable choice for financial traders. It uses two lines, %K for raw data and %D as its moving average, indicating overbought and oversold conditions. A stochastic indicator is powerful for spotting potential reversals through divergence signals. This happens when stochastic does not agree with the current price action (e.g., price making lower lows, while stochastic starts to make higher highs). If a trader uses fast settings (smaller periods), the indicator will spot rapid price movements, but it will also generate more false signals. It is also essential to combine stochasticity with other indicators of analysis methods (support and resistance levels, trend lines, etc) to confirm its signals.

It is also important to integrate risk management strategies to limit losses using stop loss orders and backtest stochastic-based strategies on historical data, and then try it on a demo account before going live.