What does swap mean in trading foreign currencies?

When traders open a

margin account, they reach some sort of agreement with their Forex broker: they will borrow funds from it and when trading is done, return it. But, it’s not like such loans come without additional requirements. Here is where the swap meaning in Forex comes in.

It’s like taking a loan from the bank

Before we explain what is swap in Forex trading, let’s take a quick example of how the actual loan work and how it is similar to margin trading. Let’s imagine you want to borrow $5,000 from your bank. You go there and talk to the loan officer, who tells you that the interest rate for your loan will be 2%.

So, you get the loan and start paying it monthly. Let’s say you made the application for a year, which means you have to pay a monthly fee 12 times. You would imagine that the payment must be around $417 per month (5,000/12) and you should return that $5,000 back to the bank.

However, that is not how the financial system works. Because you borrowed funds from the bank, which means it gave you $5,000 from its budget, you also need to pay for the service. So, not only should you bring $5,000 back, you also have to put additional interest on top of that.

Because the interest rate was 2%, this means that you’ll be returning $5,100 to the bank, where those 100 US dollars will be a service payment. So, that’s basically how swaps work in Forex margin trading. Forex brokers can be considered as banks and traders as borrowers. Swaps are interest rates for leveraged funds.

How do Forex swaps work?

Swaps don’t occur when a trade happens within a day. For example, if you open a position in the morning and close it in the evening, there will be no additional interest rates charged or added (credited) to your account. But if you decide to leave the position open for more than a day, then swaps will become active.

There are two types of currency swaps that are related to the actual positions: if a trader wants to buy a currency pair and leave it overnight, the position will have a long swap; on the other hand, if a trader wants to sell the Forex pair for more than a day, the position will have a short swap.

The amount of the interest rate for individual currencies depends on the decisions of central banks. Since every central bank has a different policy, the interest rates are different as well. This difference decides whether a swap is credited or charged to the trader’s account.

Actually, the amount credited or charged depends on even more factors, namely on:

- The difference between the interest rates of individual currencies

- The Forex broker’s commission rates

- The day when a trader opens the position

- The actual price movements of the currencies

- Other brokers’ swap indicators

In this guide, we are going to focus on the first three factors and see how a Forex interest rate swap changes in different circumstances. Let’s begin with the interest rate difference between the currencies.

Currencies with different interest rates and broker commissions

As you may already know, Forex traders use currency pairs as trading assets. Currency pairs consist of two individual currencies: a base (the first) currency and a quote (the second) currency.

As we have already mentioned, every currency has its own interest rate determined by the central bank. The difference between the interest rates in a currency pair will either be credited to the trader’s account or charged from it. The difference between the swaps (interest rates) is called carry, while the traders who leave their positions open for more than a day and use this feature are called carry traders.

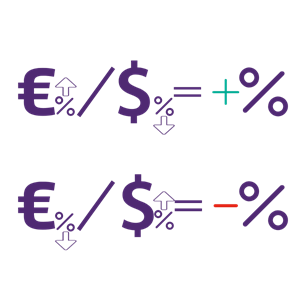

In general, if a currency that is bought has a higher interest rate than the one that is sold, a swap will be credited to the account. And if the interest rate is lower for the bought currency, then a swap will be charged from the account.

Another main factor, as we said earlier, is the broker’s commission rate. Depending on whether a swap is charged or credited to the account, the broker’s swap commission will either increase the charged swaps or reduce the credited swaps.

A real-life example of a FX swap

To make these factors a bit easier to understand, let’s take a look at this Forex swap example: Let’s say you opened a long EUR/JPY position for one lot (100,000 units). A long position means that you bought euros by selling Japanese yen. So, your position is worth 100,000 yen.

Now, let’s assume the EUR/JPY asking price is 119.23, the interest rate of EUR is 4.15%, and the interest rate of JPY is 3.5%. Because you are buying euros and selling yen, and because the euro has a higher interest rate than the yen, a certain amount of swap will be credited to your account.

As for the exact FX swap rate definition and how to calculate it, we need several things: a position size (100,000), a price of the currency pair (119.23), the difference between interest rates (4.15-3.5=0.65%), the broker’s commission (let’s say it’s 0.15%), and the number of days in a year (365).

Here’s what the calculation looks like:

Swap=(position × (interest difference - commission) / 100) × price / days per year

For our example, a swap will be:

(100,000 x (0.65 - 0.15) / 100) x 119.23 / 365=163.33 JPY

Now, because the interest rate was higher for EUR that you bought, a swap of 163.33 yen will be added to your account when the position rolls over the next day. If you were selling the euros and buying the Japanese yen, then instead of subtracting the broker’s commission, we would be adding it to the interest rate differential, and it would look like this:

(100,000 x (0.65 + 0.15) / 100) x 119.23 / 365=261.32 JPY

Therefore, 261.32 yen will be charged from your account when the position rolls over the next day. This is how the two factors - the difference between interest rates and the broker’s commission - determine the amount of a swap, as well as whether it’s going to be credited or charged.

Wednesday-Thursday swaps

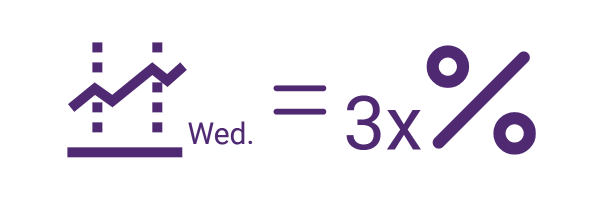

There’s also another important factor that is worth mentioning here. When a trader opens a position on Wednesday and keeps it open on Thursday as well, a swap will become triple in size.

That’s because of how the swap values are calculated. Instead of having the value of the same day, the swap value dates are pushed two days forward. For example, a swap for Monday will have Wednesday as a value date. And for Wednesday, the value date is Friday.

However, when the position rolls over to Thursday, the currency swap value cannot be set on Saturday. That’s because the Forex markets do not work on the weekends. Therefore, the date should be pushed even further, all the way to Monday, which generates three days of difference. And that’s why the swaps - both credited and charged - become triple in size.