Weekly Market Commentary | 15.04 – 21.04

15 April 2024

Curious to know what’s happening on the markets this week? Take a quick tour of the latest news, economic updates, and trading setups that will keep you up-to-date and in the know!

Monday:

- Today’s shaping up to be busier than your typical Monday! Keep an eye out for:

- Retail Sales figures from the US. Will consumers be splurging or saving?

- The Empire State Manufacturing Index is also on the agenda, with expectations set at -5.2. Let’s see how the manufacturing sector is faring.

Tuesday:

- Get ready for a global economic tour:

- China kicks off with Industrial Production, aiming for a 6% mark.

- The UK steps in with Claimant Count Change, projected at 17,200.

- Meanwhile, Canada's inflation figures are expected to rise by 0.7% monthly.

- Plus, catch speeches from banking bigwigs like Bank of England's Bailey, Bank of Canada's Macklem, and Fed Chair Powell.

Wednesday:

- It's Inflation Day!

- New Zealand and the UK both take the stage, hoping for 0.6% and 3.1%, respectively.

Thursday:

- Down Under delivers job data from Australia, while the US reveals its Unemployment Claims. Stay tuned!

Friday:

- Wrapping up the week:

- The UK presents its Retail Sales numbers, aiming for a 0.3% boost. Let's see how the week wraps up!

Setups for This Week:

S&P 500:

- Primary View: The price has departed from the channel up formation, now navigating within a smaller flag or channel down formation. Sentiment remains negative while bounded by the black lines.

- This consolidation suggests a potential continuation of the downward trend.

- Watch for a breach below the lower black line for further confirmation of bearish sentiment.

- Alternative View: A breakout above the upper black line could signal a reversal, turning sentiment bullish.

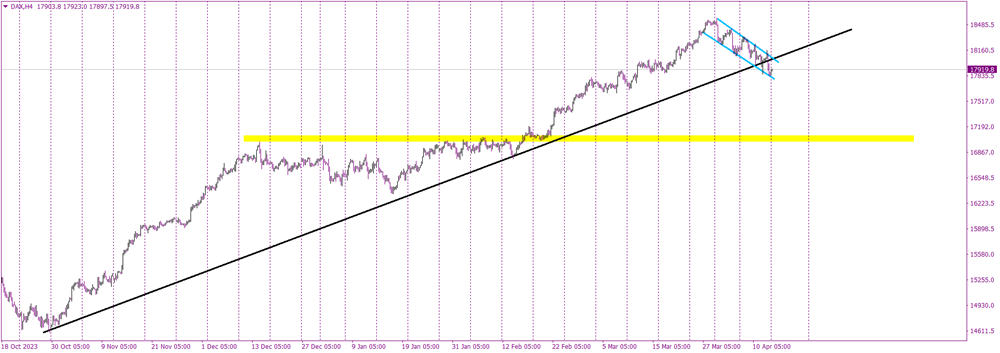

DAX:

DAX:

- Primary View: The price has breached a long-term uptrend line, marked in black, signaling a negative trend. Remaining within the boundaries of the blue lines reinforces the sell signal.

- Continued movement within this range suggests further downside potential.

- Monitor for sustained movement below the black line for confirmation of bearish sentiment.

- Alternative View: A return above the black trendline could indicate a shift in sentiment, prompting a buy signal.

.

Silver:

- Primary View: Friday's session closed with a bearish shooting star candlestick pattern, signaling a potential bearish correction. The yellow horizontal support becomes the target for this correction.

- This pattern suggests downward pressure and a possible retest of support levels.

- Monitor price movement for confirmation of continued bearish sentiment.

- Alternative View: A move above Friday's highs could signify a significant long-term buying opportunity, reversing the bearish outlook.