Weekly Market Commentary | 16.09 - 20.09

16 September 2024

Curious to know what’s happening on the markets this week? Take a quick tour of the latest news, economic updates, and trading setups that will keep you up-to-date and in the know!

Monday:

-

Asian markets are off today, with key markets like Japan and China closed for public holidays, so expect lower liquidity and volume in the early hours of the day.

-

The key data to watch will come from the US with the Empire State Manufacturing Index. This index is expected to show a slight contraction, forecasted at -4.1. Any surprise here could set the tone for the week in US equity and currency markets.

Tuesday:

-

Attention shifts to Canada, where inflation data will be released. It is expected to cool down to 0.1%. Any deviations from this figure could influence the Canadian Dollar and the Bank of Canada's policy direction.

-

The day wraps up with retail sales data from the US. Core retail sales are expected to come in at 0.2%, which will offer insight into consumer spending trends in the world's largest economy.

Wednesday:

-

Big day ahead with UK inflation data kicking off the session. Inflation is expected to fall to 2.2%, which could provide relief for the British Pound if confirmed, or signal that the UK’s economic challenges are far from over if inflation surprises higher.

-

The most important event of the week arrives with the interest rate decision from the US Federal Reserve. Markets are nearly certain of a rate cut, but the size is still up for debate – will it be 25 or 50 basis points? The announcement will likely trigger significant volatility in global markets.

Thursday:

-

The day begins with a focus on New Zealand, where GDP is expected to shrink by 0.4%. This could add pressure on the New Zealand Dollar, especially if the data is worse than expected.

-

Australia also releases its job data, another critical piece of the puzzle for the Australian Dollar. Job growth will be key in determining the country's economic outlook.

-

In the UK, an interest rate decision is expected, with no change forecasted, keeping the rate at 5%. The central bank's tone will be closely watched, as the British economy grapples with both high inflation and slowing growth.

Friday:

-

The week ends with a flurry of activity, starting with an interest rate decision from Japan. No changes are expected, but traders will watch for any signs of shifting policy as the Yen continues to underperform.

-

The UK releases retail sales data, expected at 0.4%. Consumer spending trends will shed light on how the broader UK economy is faring amidst high inflation and stagnant growth.

-

Canada wraps up the week with its own retail sales data, forecasted at 0.3%, which could influence the Canadian Dollar heading into the weekend.

Setups for This Week:

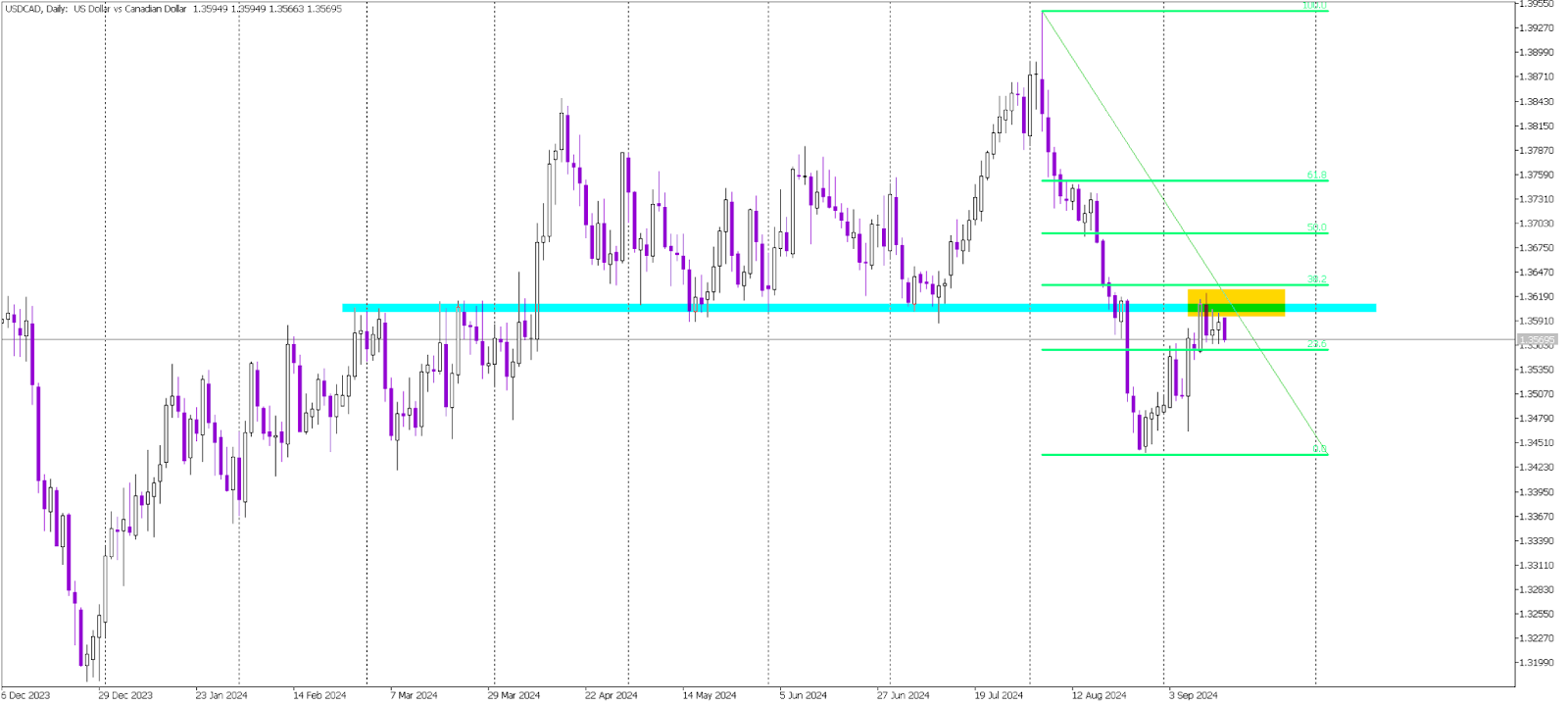

USDCAD

Primary View:

-

The price bounced off a key horizontal resistance marked with blue color.

-

We are also bouncing off the 38.2% Fibonacci retracement, so this area marked with orange color is absolutely critical resistance. As long as we stay below, the sentiment remains negative.

Alternative View:

USDPLN

Primary View:

Alternative View:

EUR/GBP

Primary View:

-

The price is currently trading inside a flag formation marked with black lines, and this pattern typically promotes a breakout to the downside.

-

A breakout below the lower line of the flag will be a sell signal.

Alternative View: