Weekly Market Commentary | 22.07 - 28.07

22 July 2024

Curious to know what’s happening on the markets this week? Take a quick tour of the latest news, economic updates, and trading setups that will keep you up-to-date and in the know!

Monday

-

Markets are digesting the unexpected news of Joe Biden dropping out of the presidential race.

-

China's central bank surprised the market by cutting the short-term seven-day reverse repurchase rate from 1.8% to 1.7%.

Tuesday

Wednesday

-

A busy day filled with PMI releases from major economies:

-

Additionally, the Bank of Canada will announce its interest rate decision, expected to decrease from 4.75% to 4.5%.

Thursday

Friday

Setups for This Week:

Dow Jones

Primary View:

-

The last two days have been significantly bearish, indicating the start of a bearish correction.

-

The price is nearing key yellow horizontal support and the blue uptrend line. A bounce from these levels would signal a buy opportunity.

Alternative View:

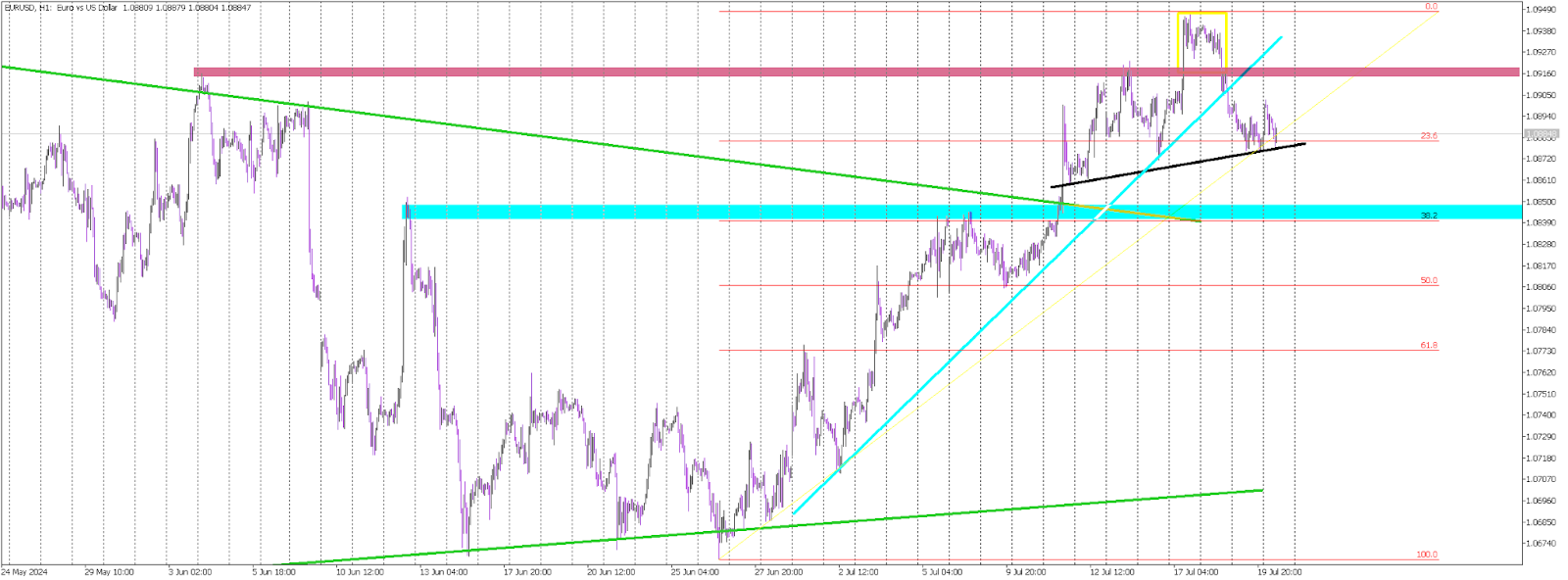

EUR/USD

Primary View:

Alternative View:

EUR/JPY

Primary View:

Alternative View: