Weekly Market Commentary | 30.12 - 05.01

30 December 2024

Curious to know what’s happening on the markets this week? Take a quick tour of the latest news, economic updates, and trading setups that will keep you up-to-date and in the know!

Monday

-

Inflation from Spain: CPI is expected to come in at 2.6%, offering insight into European price trends.

-

Chicago PMI: Anticipated at 42.7, this indicator will shed light on manufacturing activity in the U.S. Midwest.

-

Pending Home Sales (U.S.): Expected to rise by 0.9%, signaling potential momentum in the U.S. housing market.

Tuesday

-

Market Closures: Japanese, German, New Zealand, and Australian markets will remain closed for the final trading day of 2024.

-

China Manufacturing PMIs: Expected at 50.3, this release will hint at the state of manufacturing activity in China as the year ends.

Wednesday

Thursday

-

Market Reopenings: After the holiday break, trading resumes.

-

Unemployment Claims (U.S.): This weekly figure will provide an early gauge of labor market trends heading into the new year.

-

Final Manufacturing PMIs (U.S.): Expected at 48.3, giving a clear picture of the sector's performance for December.

-

Crude Oil Inventories (U.S.): A key release for energy traders, reflecting supply trends.

Friday

Setups for This Week:

EURAUD

-

Primary View

-

Alternative View

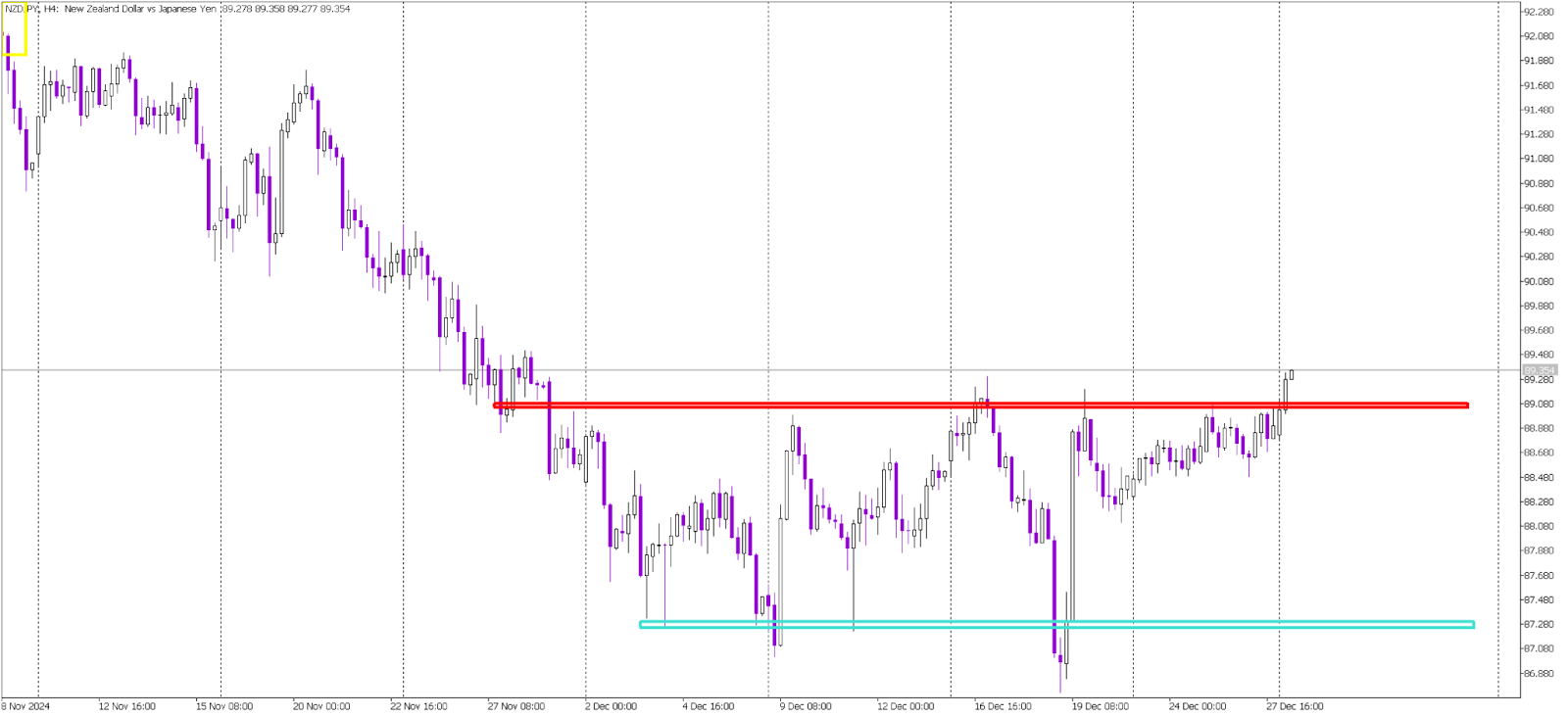

NZDJPY

-

Primary View

-

The price is breaking above key horizontal resistance marked with red.

-

As long as we stay above this level, the sentiment remains positive.

-

Alternative View

USDCAD

-

Primary View

-

Alternative View