Weekly Market Commentary | 14.10 - 18.10

14 October 2024

Curious to know what’s happening on the markets this week? Take a quick tour of the latest news, economic updates, and trading setups that will keep you up-to-date and in the know!

Monday:

-

As usual, Monday is quiet with no Tier 1 data scheduled.

-

Japanese, Canadian, and American markets are closed today, which means lower liquidity and likely subdued volatility.

Tuesday:

-

The day starts with Claimant Count Change from the UK, expected at 20.2K.

-

Later, we’ll have inflation data from Canada, which is expected to stay the same as last month.

-

The day wraps up with inflation from New Zealand, which is forecasted to rise to 0.7%.

Wednesday:

-

Inflation from the UK will be the highlight, expected to drop to 1.9%.

-

This will be an important indicator for the British Pound as it impacts potential future monetary policy decisions.

Thursday:

-

The busiest day of the week starts with job data from Australia, giving insight into the strength of the Australian economy.

-

Followed by the ECB interest rate decision in the Eurozone, where a 25 basis points cut is expected. This will be accompanied by the ECB policy statement and press conference.

-

To finish the day, we will have retail sales data from the US, which is expected to increase by 0.3%.

Friday:

Setups for This Week:

USD/PLN

Primary View:

-

The price is moving sideways above key horizontal support and below key dynamic resistance, signaling consolidation.

-

A breakout to the upside will give us a signal to buy, supported by the double bottom formation.

Alternative View:

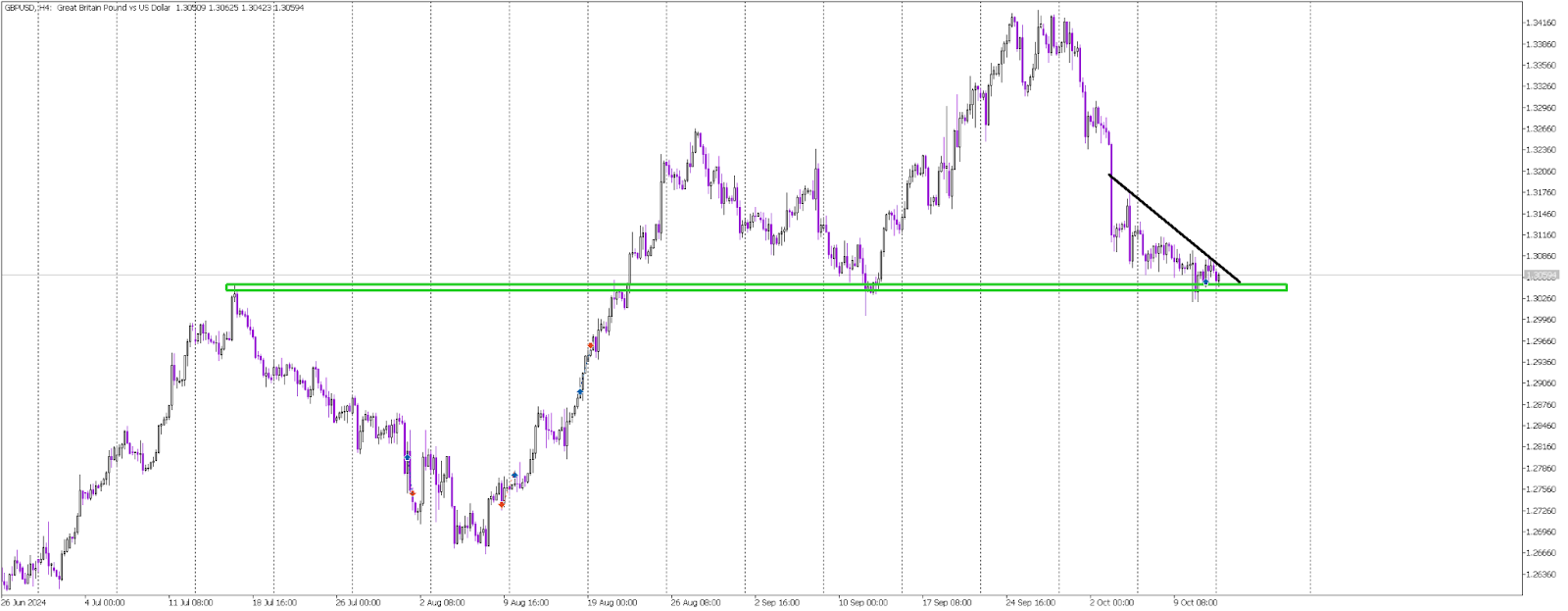

GBP/USD

Primary View:

-

The price is bouncing off key horizontal support marked with green color, showing resilience.

-

A breakout of the black downtrend line will give us a signal to buy, indicating potential bullish momentum.

Alternative View:

GBP/CHF

Primary View:

-

The price is moving sideways inside of the triangle pattern, consolidating within narrowing boundaries.

-

A breakout to the upside will give us a signal to buy, signaling potential bullish strength.

Alternative View: